| IndyWatch Crypto Currency Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Crypto Currency Feed was generated at Community Resources IndyWatch. |

|

Saturday, 04 March

21:50

Jack Dorseys TBD launches C= to improve Bitcoin Lightning Network Cointelegraph.com News

C= (pronounced C equals) aims to further the reach of the Bitcoin Lightning Network through added liquidity and routing services.

21:18

Bitcoin price would retest $25K without Silvergate saga analysis Cointelegraph.com News

Strong U.S. equities and a floundering dollar normally serve to boost BTC price action but Silvergate is the elephant in the room.

18:49

India explores offline functionality of CBDCs RBI executive director Cointelegraph.com News

In addition to offline functionality, RBI is gauging CBDCs potential for cross-border transactions and linkage with legacy systems of other countries.

18:40

Bankman-Fried Should Have Only Flip Phone, Website Whitelist, DOJ Says CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Sam Bankman-Fried leaving court on February 16, 2023 (Liz Napolitano/CoinDesk)

17:36

Nifty News: Dan Harmons NFT show set for season 3, NFT-friendly Square Enix CEO steps down and more Cointelegraph.com News

Square Enixs NFT-friendly CEO is stepping down, but it may not impact the firms NFT plans, and Disney-backed Baobab Studios first NFT drop sells out.

16:00

Binance.US Is Operating 'Unregistered Securities Exchange,' SEC Official Says CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Binance .US at Bitcoin Miami 2022 (Danny Nelson/CoinDesk)

16:00

Australian Dollar and Bitcoin coinmill.com Currency Rates

1.00 AUD = 0.00003 BTC

0.00010 BTC = 3.30 AUD

Converter

Bitcoin and United States Dollar coinmill.com Currency Rates

0.00010 BTC = 2.24 USD

1.00 USD = 0.00004 BTC

Converter

13:57

Galaxy tips Bitcoin NFT market to hit $4.5B by 2025 Cointelegraph.com News

Galaxys estimation was based on the rapid uptick of interest in Bitcoin NFTs, currency market infrastructure, and the potential to take some market share away from Ethereum.

10:49

Silvergate Closes SEN Platform Institutions Used to Move Money to Crypto Exchanges CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Silvergate CEO Alan Lane (Silvergate)

09:10

The Rise and Fall of Silvergates Crypto Business CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(Charlotte Harrison/Unsplash, modified by CoinDesk)

09:02

08:59

Binance launches anti-scam campaign after Hong Kong pilot run Cointelegraph.com News

The new campaign features a withdrawal warning message that attempts to prevent users from sending their crypto to scammers.

08:44

US legislators renew call for EPA investigation of crypto mining emissions data Cointelegraph.com News

Senator Edward Markey and Representative Jared Huffman want miners to disclose emissions data and the EPA to lead an investigation of their impact.

08:35

08:15

Uniswap wants to launch mobile wallet, but Apple wont greenlight its launch Cointelegraph.com News

Despite having its first build approved in October, Uniswap Labs is facing issues with Apples App Store regarding its mobile wallet.

08:00

DeFi to be examined at inaugural CFTC tech advisory meeting: Finance Redefined Cointelegraph.com News

French police arrested two individuals in connection with the Platypus exploit in the month of February.

07:38

07:29

07:28

07:16

Has Tokenizations Moment Finally Come? CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(imaginima/GettyImages)

07:15

07:14

07:00

Blockchain projects face 'lack of appetite' from US regulators, says Austin Federa Cointelegraph.com News

The Solana Foundations head of strategy said he had heard from projects facing pretty draconian rules in the European Union related to shifting to non-custodial wallets.

06:54

06:24

ETHDenver Looks Cringey to You Because Ethereum Has an Actual Community CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Uniswap booth at ETHDenver 2023 (Danny Nelson/CoinDesk)

06:24

Uniswap Wants to Launch Crypto Wallet App, but Apple Says Not So Fast CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Uniswap Labs design lead Callil Capuozzo at ETHDenver 2023 (Danny Nelson/CoinDesk)

06:15

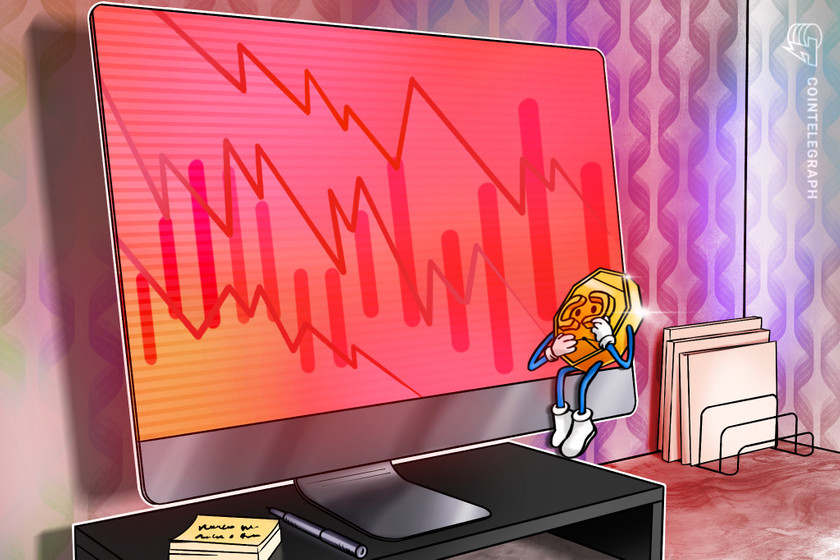

Price analysis 3/3: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC Cointelegraph.com News

Concerning news from Silvergate Bank and FTX may have influenced investors decision to press the sell button, but the potential for further downside could be limited.

06:08

U.S. Lawmakers Reintroduce Bill to Force Crypto Miners to Disclose Emissions CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Sen. Edward Markey (D-Mass.) is cosponsoring a bill to mandate that crypto miners disclose their greenhouse gas emissions. (Jemal Countess/Getty Images for We The 45 Million)

06:06

Neal Stephenson Says AI-Generated ChatGPT Is Simply Not Interesting CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Neal Stephenson, the writer who came up with the terms "metaverse" and "avatar," seen here in 2016 (Steve Jennings/Getty Images for TechCrunch)

05:01

Total crypto market cap takes a hit amid Silvergate Bank crisis Cointelegraph.com News

The total crypto market cap slipped below $1.025 trillion as concerns over Silvergate Banks solvency triggered a sharp sell-off in BTC, ETH and altcoins.

05:00

Crypto Biz: Did crypto winter scare off Visa and Mastercard? Cointelegraph.com News

Visa's head of crypto has pushed back against the notion that the credit card giant is getting cold feet because of the bear market.

04:47

Chainlink Price Feeds Go Live on Base, Coinbases Layer 2 Testnet CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Chainlink CEO Sergey Nazarov (Chainlink Labs)

04:03

How do the Feds interest rates impact the crypto market? Cointelegraph.com News

Cointelegraph analyst and writer Marcel Pechman explains how the U.S. Federal Reserves interest rates impact the crypto market.

04:00

assets, but there is a silver lining Cointelegraph.com News

Market analyst Charles Edwards says that while there are good reasons to exercise caution, investors risk-off sentiments and expectation of a recession could be overblown.

03:52

03:35

FTX Has Massive Shortfall in Assets, Say Bankruptcy Lawyers CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

John J. Ray III, CEO of FTX Group (Nathan Howard/Getty Images)

03:29

Before Silvergate and After Silvergate CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Silvergate CEO Alan Lane (Silvergate)

03:28

Bitcoin Long Liquidations Hit Highest Level Since August CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Bitcoin's long liquidations (Glassnode)

03:25

Bitcoin Miner Riot Delayed 10-K Filing Due to Impairment Calculation Issues CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

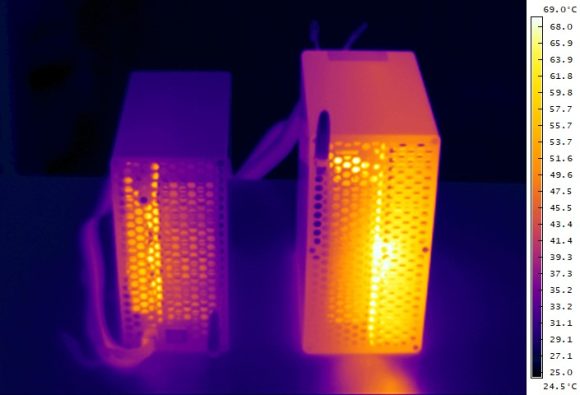

A closeup of one of Riot's mining rigs. (Riot Blockchain)

03:23

U.S. Lawmakers Argue SEC Accounting Policy Undermines Safe Crypto Custody CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

U.S. Sen. Cynthia Lummis (left) and Rep. Patrick McHenry (Shutterstock/CoinDesk)

03:22

03:16

02:56

DeFi Protocol Yearn Finance's Token Rises 7% Despite Crypto Market Plunge CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

YFI's price chart (Cryptowatch)

02:50

Bitcoin-Bridged to Avalanche Reaches Record Daily Mint of Over 2K BTC CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Interest in bridging BTC to Avalanche continues to swell. (Matthew Lancaster/Unsplash)

02:41

02:38

Bankrupt Crypto Lender Celsius Reopens Withdrawals for Certain Custody Accounts CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Celsius Network is now allowing withdrawals from some accounts after freezing the accounts last June. (Unsplash)

02:36

First Mover Americas: Crypto Markets Sinking on Silvergate CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Silvergate Bank's woes are slamming the broader crypto market. (Will Foxley/CoinDesk)

02:30

Coinbase announces acquisition of One River Digital Asset Management Cointelegraph.com News

As part of the acquisition, Coinbase said One River Digitals team would join the exchange and CEO Eric Peters would stay to lead the firm under the name Coinbase Asset Management.

02:29

Bitcoin price settles at $22.4K as daily RSI retraces 2023 bull run Cointelegraph.com News

Bitcoins RSI is back at square one as the mood among traders becomes uncertain after 5% BTC price losses overnight.

02:25

02:21

02:00

ConsenSys zkEVM set for public testnet to deliver secure settlements on Ethereum Cointelegraph.com News

ConsenSys will release its zkEVM rollup to its public testnet on March 28, paving the way for an eventual mainnet integration later in 2023.

01:04

Top 7 Wall Street movies you must watch Cointelegraph.com News

Discover the best of Wall Street cinema with these top seven films, featuring captivating tales of finance, ambition and power.

01:01

Regulation and risk: Factors driving demand for a euro-backed stablecoin Cointelegraph.com News

The worlds second most widely held reserve currency seems to be underrepresented in the stablecoin space.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Friday, 03 March

23:46

The metaverse is testing the limits of what is legally possible Cointelegraph.com News

While digital events and spaces have become increasingly common over the last few years, is digital reality the right place for all types of gatherings, such as court proceedings?

23:15

Dollars sharp recovery puts Bitcoins $25K breakout prospects at risk Cointelegraph.com News

Persistent inflation and a strong labor market create conditions for more Fed rate hikes in 2023, which may push Bitcoin down against the U.S. dollar.

22:20

Coinbase cutting ties with Silvergate forces crypto hedge fund to find a new bank Cointelegraph.com News

A total of five crypto companies ended their partnership with Silvergate Bank on March 2 after a series of lawsuits and investigations against the bank.

21:05

Ripple survey: 97% of payment firms believe in the power of crypto Cointelegraph.com News

The lack of regulatory clarity is the biggest hurdle to the adoption of crypto-enabled payments, according to a new survey co-hosted by Ripple.

20:44

UAE free zone to explore Bitcoin payments for services, lawyer says Cointelegraph.com News

The free zone for virtual asset firms in the Ras Al Khaimah emirate aims to foster regulated and non-regulated activities.

18:27

Why is Bitcoin price down today? Cointelegraph.com News

Bitcoin price is down today after Silvergate bank liquidity concerns combine with an exchange margin cascade, pressuring crypto markets.

16:56

US lawmakers argue SEC accounting policy places crypto customers at risk Cointelegraph.com News

While the bulletin was intended to provide clarity regarding the accounting treatment for digital assets, it has been criticized by both lawmakers and regulators.

16:34

Binance USD market cap falls below $10B amid rising regulatory concerns Cointelegraph.com News

BUSDs market cap is down by nearly $14 billion from its all-time high of $23.49 billion, set on Nov. 15, 2022.

15:02

Celsius Custody customers finally begin withdrawals 263 days after freeze Cointelegraph.com News

Celsius users with funds held in its custody program have finally begun to withdraw funds, but users report delays due to a backlog of requests.

14:29

SEC objection to Voyager-Binance.US deal questioned by US judge Cointelegraph.com News

A United States judge scolded the Securities and Exchange Commission over its vague objection to Voyagers restructuring deal and asked for specifics on its concerns.

10:09

10:07

What Now for Crypto Banking? CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Custodia Bank CEO Caitlin Long (CoinDesk TV)

10:06

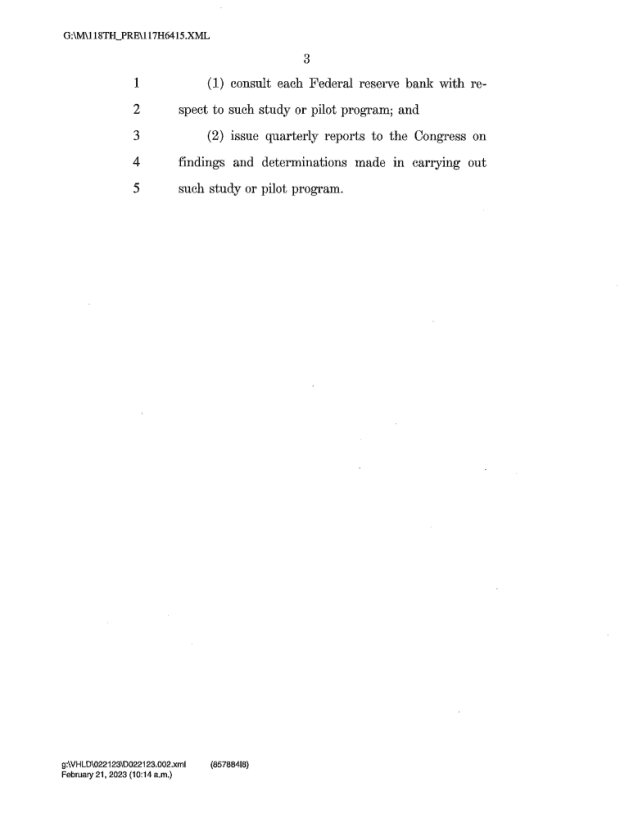

Bitcoin Miner Marathon Digital Sold Almost All Bitcoin Mined in February CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Marathon Digital CEO Fred Thiel (CoinDesk)

08:48

Advisors: Learn Crypto, or Your Clients Will CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(artpartner-images/The Image Bank/Getty)

08:20

Regulators Are Bringing the Multichain Era to a Close CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(Cristina Gottardi/CoinDesk)

08:04

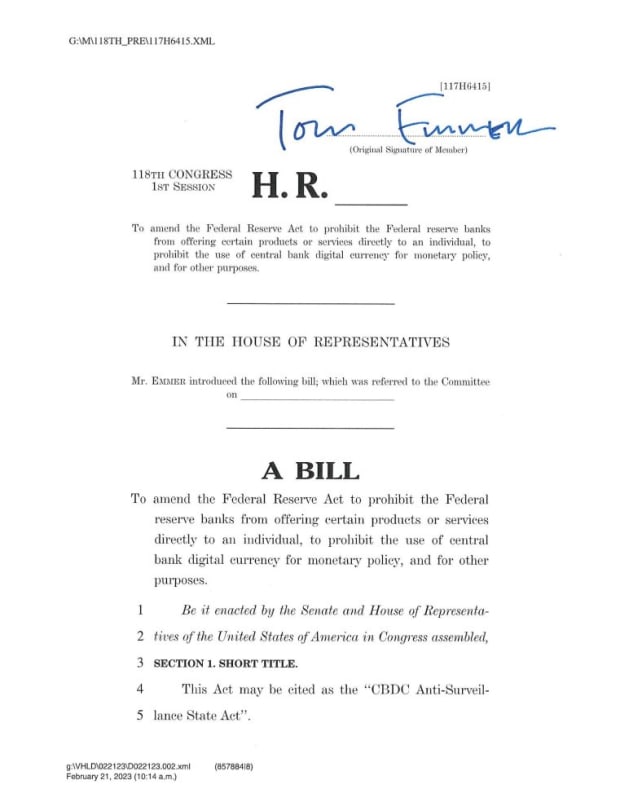

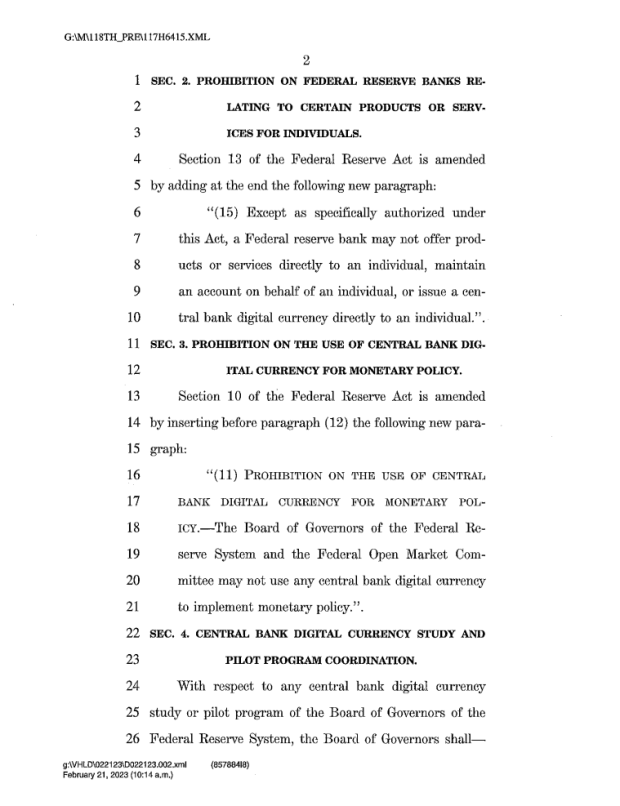

U.S. Treasury Introduces CBDC Working Group, Discusses Potential Routes For Digital Dollar Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

The Treasurys statements explore the potential forms and implementations of an American CBDC.

The U.S. Department of the Treasury has released comments from Undersecretary for Domestic Finance Nellie Liang on the Next Steps to the Future of Money and Payments, addressing CBDCs and the approach the American government is taking to their potential implementation.

The original Treasury

report released in September 2022 described the formation of a

CBDC working group that would advance work on a CBDC. Liangs

remarks confirmed the formation of that group.

One of the central tasks for the CBDC Working Group is to

complement the Feds work by considering the implications of a U.S.

CBDC for policy objectives for which a broader Administration

perspective is helpful, Liang said. To give you a sense of how we

are pursuing this work, I will describe our approach to thinking

about CBDC options, the policy questions we are attempting to

answer, and the kinds of recommendations we hope to develop.

Highlights from this description include a look at the potential forms that a CBDC could take, the potential for a separate retail and wholesale CBDC and the possible core features of the CBDC. Also discussed is the idea that a potential U.S. CBDC, if one were created, would best serve the United States by being intermediated, meaning that the private sector would offer accounts or digital wallets to facilitate the management of CBDC holdings and payments. In terms of technology, a retail CBDC might involve a different architecture compared to a CBDC that is intended solely for wholesale use.

In his piece for Bitcoin Magazine, Mark Goodwin described how

Bitcoiners may have spent so much time looking for CBDCs, we missed

the private-entity stablecoin monster right in front of our

eyes.

The Treasurys released remarks suggest that a CBDC may well come on

the backs of private entities, with major incentives to

participate. The United States has gotten serious in regards to its

consideration of a CBDC. And all this

just as legislation has been introduced by Republican lawmakers

that would prohibit the Federal Reserve from issuing a CBDC

directly to anyone.

Although this bill may not have much of a chance of passing, notable is the specific angle of preventing a Federal CBDC, potentially leaving free those intermediated by private parties.

The remarks also described how a CBDC is one of many directi...

08:01

Bitcoin Price Holds Steady Above $23K as Silvergate Capital Crumbles CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Bitcoin price chart for past 24 hours (CoinDesk/highcharts.com)

07:56

MicroStrategy Says It Doesnt Have Any Assets Custodied With Silvergate CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

MicroStrategy Executive Chairman Michael Saylor (Marco Bello/Getty Images)

07:55

Keep Crypto in America CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(Sonny Ross/CoinDesk)

07:21

Now You Can Mine KASPA (KAS) on f2pool With 500K KAS Contest for Miners Crypto Mining Blog

The f2pool has just launched its Kaspa mining pool today with a 1% PPLNS payout scheme for KAS mining and the pool is running a contest to attract miners who will be competing for 500,000 KAS in total prizes. The Kaspa (KAS) mining contest will run starting on 2022-03-02 10:00 UTC until 2022-03-12 10:00 UTC, with the Top 20 miners by daily average KAS hashrate at f2pool going to receive rewards in proportion to their hashrate contribution from a total prize pool of 500,000 KAS coins. Apparently, the contest is favouring the bigger miners and not the small home miner, so a fairer distribution of the reward among miners could be used in order to attract all kinds of KAS miners still it is nice to see that more of the crypto ecosystem is now slowly starting to adopt KAS support.

With the recent price increase for Kaspa (KAS) going past 1 US cent and keeping it there for a while there is increased interest in the project that is still generally kind of on the sidelines for many people into crypto. It is good now that GPU miners are making profit mining KAS and it is not only Kaspa, but some other new POW project are on the positive side regarding actually making profit after you pay for the electricity used. And Kaspa, although really good already in terms of speed has even more to offer with the upcoming upgrades, so if you still havent checked it out you might want to dig a bit deeper on blockDAG and the GHOSTDAG protocol and what KAS has in store for the near future as well.

To read more about the addition of Kaspa on f2pool and their 500K KAS competition

07:15

Near Protocol Starts Blockchain Operating System to Focus on User Experience CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Near co-founder Illia Polosukhin (Danny Nelson/CoinDesk)

06:57

Former NBA Player Baron Davis Says Celebs Will Focus More on 'Utility' Tokens CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Former NBA player Baron Davis is trying his hand in blockchain technology with an NFT-based project. (Paul Archuleta/Getty Images)

06:45

HSBC, Nationwide Banks Crack Down On Bitcoin And Crypto Access Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Two of the U.K.s largest banks have imposed further restrictions on their customers ability to acquire cryptocurrencies.

British banks have continued to crack down on their customers' cryptocurrency purchases. According to a Bloomberg report, Nationwide and HSBC are the latest U.K. banking giants to impose new limits on their customers cryptocurrency purchases via debit cards and end purchases with credit cards.

Nationwide is applying daily limits of 5,000 ($5,965) on debit-card purchases of cryptoassets, the building society informed customers on Wednesday, while its credit cards can no longer be used to buy crypto. HSBC said it barred customers from making crypto purchases via its credit cards from last month, reads the report. HSBC states that the decision is due to alleged financial risk to customers.

The report describes how Most of the major [U.K.] banks have also implemented exchange-specific restrictions, with the worlds largest crypto platform Binance Holdings Ltd. the most popular target.

Bitcoin Magazine covered the start of these moves from U.K. banks in tandem with increasing discussion of a U.K. CBDC. Alison Rose, CEO of NatWest Group, described how the bank had taken a pretty hard line on cryptocurrency due to the instability and volatility of the platforms and the risk of fraud, citing social media and technology platforms as the frauds primary source.

These new limitations on customers places U.K. citizens at a further disadvantage in regards to acquiring bitcoin. As such developments are taking place, it highlights the need for more decentralized, peer-to-peer exchanges that can facilitate no-KYC bitcoin transactions.

06:35

06:33

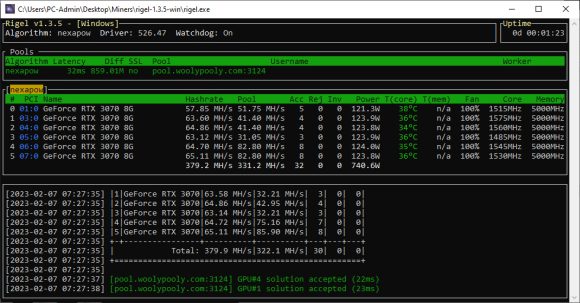

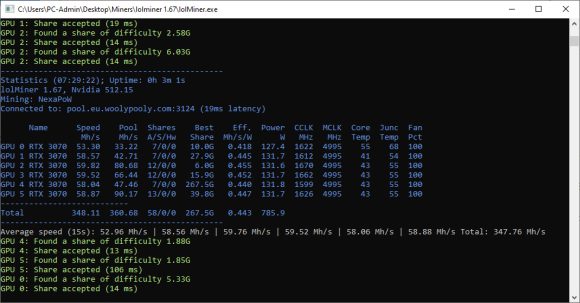

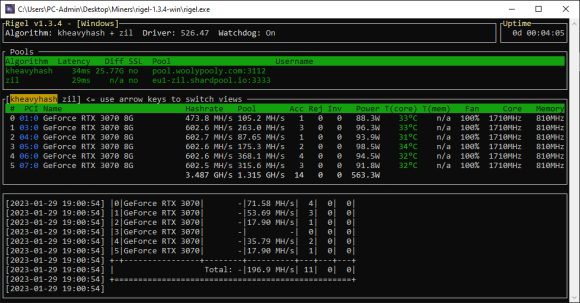

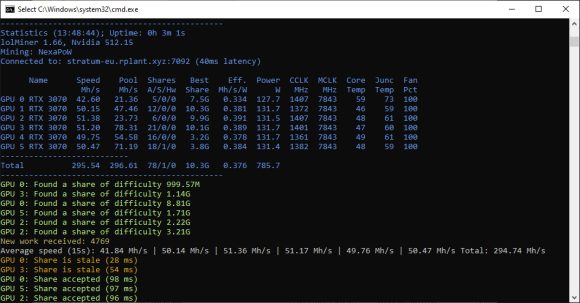

New lolMiner 1.69 and BzMiner v13.3.0 Bring NEXA Support for AMD GPU Miners Crypto Mining Blog

While the latest updates of lolMiner and BzMiner are not the first to bring support for the Nexapow algorithm used by the NEXA project, they currently offer the fastest performance on AMD GPUs. Previously you could mine NEXA on AMD GPUS only suing the WildRig Multi miner, now you can get significant performance boost with either the latest lolMiner 1.69 or BzMiner v13.3.0 (NEXA support is being jointly developed by both). Depending on your AMD GPU you could expect to get somewhere between about 12 and 20 percent performance boost compared to mining NEXA using the WildRig Multi miner, so if you were already mining NEXA on AMD GPUs you might want to upgrade your mining software now.

Meanwhile the NEXA project has also announced that it will be listed on the MEXC Global exchange at 14:00 on Mar 7 (UTC), bringing significant exposure to the crypto project to much wider market with MEXC being in the TOP 20 exchanges in terms of trading volume according to CoinMarketCaps Exchange ranking data. So, you could expect that the interest, price and profitability of mining NEXA to also come up in the following days preceding the listing and after that as well. And that goes not only for AMD GPU miners, but also Nvidia GPU miners as well that had a heat start in being able to mine NEXA early on it might still not be too late to join though.

To download and try

the latest lolMiner 1.69 AMD/Nvidia GPU miner

To download and

try the latest BzMiner v13.3.0 AMD/Nvidia GPU miner

06:30

Binance Announces Support For New African Currencies Without Third Parties Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Users from Liberia, Sierra Leone and more can now directly utilize their local currencies to buy and sell bitcoin through Binance P2P.

Cryptocurrency platform Binance has announced that its peer-to-peer (P2P) marketplace will now support more African currencies, including Liberian dollar (LRD), Sierra Leonean leone (SLL), Gambian dalasi (GMD), Mauritanian ouguiya (MRO), and Cape Verdean escudo (CVE).

Users in these regions can now transact with other users in

their local currencies without a third party or intermediary. Users

can also trade and post trade advertisements in the newly supported

currencies or directly trade BTC with other users at zero fees.

Director for Binance in West and East Africa, Nadeem Anjarwalla,

said, Binance has continued to remain committed to increasing the

adoption and mainstream accessibility of crypto, and we are excited

to be taking this step in making access to digital assets

effortless for more Africans."

In addition, users who frequently receive cryptocurrencies, as

well as LRD, SLL, GMD, MRO, and CVE, can now become merchants on

Binance P2P. According to the press release, this will enable them

to receive exclusive customer support, verified badges and access

to advanced trading tools. Merchants also enjoy VIP discounts and

zero fees on the platform. To apply, users can visit the Binance

P2P website.

By providing access to broad financial tools while maintaining one

of the lowest fees in the business, Binance aims to make crypto

accessible to everyone in Africa and beyond.

06:07

House Digital Assets Panel Chair Ready to Work With Ag Committee on Crypto Framework CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

U.S. Capitol building (Getty Images)

06:05

06:02

06:00

05:50

04:46

Xapo Bank Becomes First Bank To Offer Bitcoin Lightning Payments Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Xapo is partnering with Lightspark to allow its customers to send bitcoin near-instantaneously to any vendor who accepts BTC over Lightning.

Gibraltar-licensed private bank Xapo Bank has partnered with Lightspark, the startup spearheaded by former Facebook crypto lead David Marcus, to integrate the Lightning Network and enable near-instant bitcoin payments for its customers.

Xapo Bank members can now make small purchases of up to $100 USD at any vendor that accepts Lightning payments, without high transaction fees and long blockchain confirmation waiting times. This integration will make Xapo Bank the first fully licensed private bank to offer Lightning payments.

The Lightning Network enables scalable payments at millions of transactions per second across the network, reducing the time-consuming and costly experiences often faced by users who pay for small transactions in bitcoin.

Seamus Rocca, CEO of Xapo Bank, said in regards to the

partnership, "By integrating with the hyper-efficient Lightning

Network, we are the first bank in the world to streamline this

process and allow our members to pay for small purchases with

Bitcoin without having to convert to USD first." Rocca added that

Xapo Bank offers an annual interest rate of 4.1% on US dollars and

will soon be offering up to 1% on Bitcoin, to be paid out

daily.

"We're thrilled to enable the first bank on the Lightning Network

to offer instant, cheap Bitcoin payments to its customers, said

David Marcus, co-founder and CEO of Lightspark. Xapo has been one

of our early closed beta partners, and we're delighted they chose

Lightspark's enterprise-grade solution to reliably send and receive

payments on the Lightning Network without all the complexity and

operational overhead that typically comes with running a node on

it."

Xapo Bank members can pay via the Lightning Network by holding

bitcoin in the Xapo Bank App and scanning and paying an invoice at

any merchant that accepts Lightning payments.

The network charges a small fee for each transaction, and Xapo Bank

has set a fixed payment fee for 15 sats to protect members from

executing transactions with high fees.

04:45

The Big Flip: Interest Rate Expectations Repricing Upward Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

The Big Flip thesis has been gaining traction in the financial world and describes the markets misplaced belief in the path of inflation and policy rates.

The article below is a free full piece from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The Big Flip

In this article, we break down a macro thesis that has been gaining an increasing amount of traction in the financial world. The Big Flip was first introduced by pseudonymous macro trader INArteCarloDoss, and is based on the markets apparent misplaced belief on the path of inflation and subsequently the path of policy rates.

To simplify the thesis, the Big Flip was built upon the assumption that an imminent recession in 2023 was wrong. Even though the rates market had fully priced in the belief that an impending recession was likely, the big flip and recession timeline may take longer to play out. In particular, this change in market expectations can be viewed through Fed fund futures and short-end rates in U.S. Treasuries.

In the second half of 2022, as the market consensus flipped from expecting entrenched inflation to disinflation and an eventual economic contraction in 2023, the rates market began to price in multiple rate cuts by the Federal Reserve, which served as a tailwind for equites due to this expectation of a lower discount rate.

In No Policy Pivot In Sight: "Higher For Longer" Rates On The Horizon, we wrote:

In our view, until there is meaningful deceleration in the 1-month and 3-month annualized readings for measures in the sticky bucket, Fed policy will remain sufficiently restrictive and could even tighten further.

While it is likely not in the interests of most passive market participants to dramatically alter the asset allocation of their portfolio based on the tone or expression of the Fed Chairman, we do believe that higher for longer is a tone that the Fed will continue to communicate with the market.

In that regard, its likely that those attempting to aggressively front-run the policy pivot may on...

04:23

03:00

Jack Dorseys TBD Announces New Bitcoin Lightning Service Provider C= Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Lightning node operators can connect to TBD and Blocks new Lightning infrastructure starting today.

TBD, a Bitcoin-focused subsidiary of Jack Dorseys Block, has announced a new Lightning Network business called c=.

The purpose of the company is to provide infrastructure using bitcoin from Blocks treasury to make bitcoins Lightning Network more usable and reliable for developers, businesses (such as merchants that accept Lightning payments), and those businesses' end consumers, according to a press release sent to Bitcoin Magazine.

The release explains that the Lightning Network is still growing, and that transactions often fail due to liquidity shortfalls. In order to address that, c= will build infrastructure using the bitcoin it is committing to the network so that businesses and wallets can make their Lightning transactions more reliable and dependable.

Operating a node on the Lightning Network is all about connections; c= provides node operators whether bitcoin wallets, individuals, or other entities that want to use the Lightning Network with valuable connections to Lightning, describes the announcement. Through c=s LSP, any business or individual running a Lightning node can gain efficiencies and make their transactions via Lightning with minimal effort and investment without having to rely on an intermediary to custody their bitcoin.

For Lightning node operators, c= states that it will provide liquidity to enable transactions and collaborate with developers to provide more efficient routing and liquidity to node operators via APIs and services.

In 2022, when Square was renamed to Block, TBDs lead Mike Brock explained how TBDs mission is to bridge the old to the new We are building a new open-source company from the ground up focused on open protocols and open standards that all participants in the economy can benefit from. Since then, the company has explored Bitcoin-based decentralized web services in various capacities, including decentralized identifiers (DID), decentralized web nodes and more.

With this new entrance to Bitcoins second-layer scaling protocol, TBD will now have a major presence in Lightning infrastructure.

"The Lightning Network is the future of bitcoin transactions, but it's still new and it can be hard to get liquidity where you need it to send and receive your payments," said Nick Slaney, lead at c=. "Were excited to use the bitcoin in our treasury to grow the Lightning Network and our company in a mutually beneficial way," he told Bitcoin Magazine.

c= will be available for connection immediately for those seeking to operate a Lightning node and benefit from TBD and Blocks infrastructure.

01:28

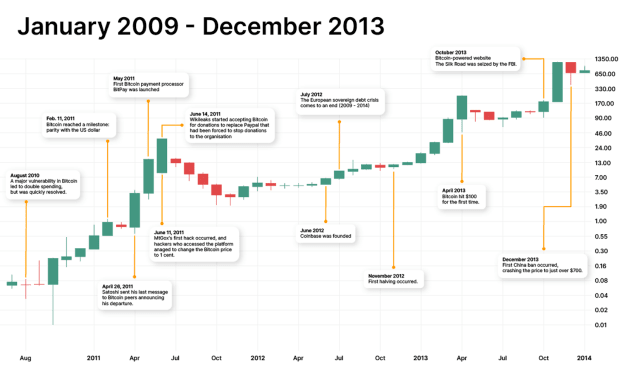

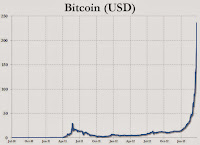

Bitcoin Price History: 2009 - 2023 Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Bitcoins past performance can help you understand where its value is heading. Heres bitcoins price history delineated since its inception.

Introduction

How many times has bitcoin been declared dead? At least 463 times. And its never been because of its monetary system failing or its technical operation breaking down, but because of its price crashing.

Some may argue that those two things tech development and price actions are inherently connected, but thats not the case.

Price swings in bitcoin are mainly driven by its own halving cycles as well as macroeconomic events. Since it roared into life from humble beginnings, bitcoin has had a turbulent history. Its infamous volatility has resulted in multiple appreciations of 1,000% in value, only to later drop by as much as 80% or even 90% such as in 2014.

Every single time, though, it has bounced back, recovered its previous highs and gone on to set new ones. This resilience has proven some of the most seasoned investors wrong and won new supporters along the way.

In this article, we take you through bitcoins price history in detail, year after year, around the critical events that shaped it as an innovative monetary system.

Price History

Bitcoin was created in 2008 to challenge the existing system of centralized, credit-based money issued by bureaucrats and unstable banks. By trusting code instead of human vulnerabilities, bitcoin offered a way out of that debacle.

At first the new invention was nothing more than an experiment, but those who read the white paper and were knowledgeable of cryptography, money and finance, could already see it turning into something much bigger than a simple cryptographic toy.

For the first year, bitcoin didnt have a market price; it had no premine or any rounds of investment from big venture capital firms. Something changed in 2010 when it started to be traded for goods and services which would set it on the path toward todays innovative and alternative currency system a journey from $0 in 2009 to $68,000 in only 13 years.

Next, well explore how bitcoin grew from a tech plaything with lofty ambitions to a bona fide monetary asset thats continuing to deliver on its promise.

January 2009-December 2013

Bitcoins proof-of-concept was emphasized in the white paper published on October 31, 2008, by Satoshi Nakamoto. All through 2009, anyone could join the network by mining blocks of Bitcoin with their computers CPUs without much effort. All things considered, the price was still $0.

2009: Genes...

00:00

Are Ordinals Really Good For Bitcoin? Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Bitcoin Ordinals have demonstrated a strong desire for collectibles on Bitcoin, but are they really the best solution for the future?

This is an opinion editorial by Olga Ukolova, the director of the board for the LNP/BP Standards Association.

Part One: I Just Love Art And Money, And I Collect Them Both

From reading up on Ordinals resources (the handbook, Ordinal theory overview, the BIP documentation), one can see there is a pretty straightforward idea behind the concept. An idea with classical numismatic roots: If I have a rare coin (and a satoshi is indeed a rare coin, as the supply is limited), then I want to store it for as long as possible, either for fun, for my personal collector pleasure and appreciation for the beauty of the coin, or for the purpose of passing it to future generations so that they can sell it at a higher price than I possibly ever could.

If we add the concept of inscriptions to this idea, then we fall even deeper down a fascinating, numismatic rabbit hole, as coins that are minted in an extremely rare supply often eventually experience a huge increase in value and can serve a great philosophical purpose.

As an example, we can see the history of the golden, double-eagle coin minted in 1933 in the U.S., which is currently worth $18.9 million, making it one of the most valuable collectibles in the world. At first, the concept of minting such a coin was proposed by U.S. President Theodore Roosevelt and was an extremely seductive opportunity for designer Augustus Saint-Gaudens who in 1905 wrote of the project, I have long wished to do what little I could to improve the shameful condition of our money, but now that I have the opportunity I approach it with fear and trembling.

Saint-Gaudens got down to business, but little did he know that the child of his noble intention would be killed by a person carrying the same name as the one who planted the seed of inspiration into his hands and mind. In 1933, President Franklin Delano Roosevelt took the country off of the gold standard, making the 445,000 gold coins illegal to own and ordering that they be gathered and melted down.

For the double-eagle piece, everything had been perfect from the stan...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 02 March

07:46

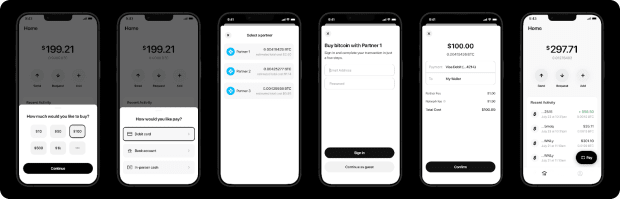

Jack Dorseys Block Releases UI Teaser, Seeks Partners For Highly Anticipated Self-Custody Bitcoin Wallet Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

A new blog post from Jack Dorseys Block detailed the progress being made on the custodial Bitcoin wallet the company is working on.

Jack Dorseys Block has updated the Bitcoin community on the development of its self-custody Bitcoin wallet.

The goal, according to a blog post, is to build a self-custody bitcoin wallet designed to empower the next 100 million people to truly own and manage their money with bitcoin. First introduced in 2022, the product principles indicate Blocks desire to create a wallet that allows users to truly own and manage bitcoin in a way that makes self-custody more accessible than ever before.

Partners will seemingly be a major part of building the self-custody wallet. Through global and local partnerships with exchanges and on/off ramp partners, we provide customers with ways to access a smooth, transparent buy and sell experience, the blog post reads, ultimately helping them navigate between fiat and bitcoin financial systems, wherever they are in the world.

The post described the criteria for Block to partner with on and offramp firms highlighting global and regional reach and depth, product experience, price transparency, customer onboarding and trust and transparency.

Customer experience is also reiterated. Per an image shared in the blog post, users will seemingly be able to choose between different partners with transparent pricing, be prompted to sign in or continue as a guest, and then seamlessly receive their bitcoin into the self-custody wallet.

Beyond these details, the blog post elucidates on retail and distribution partners and payment partnerships., saying In order to reach customers globally, we will build partnerships with companies who already have an established distribution network and ability to help our customers pay for the wallet with the most relevant local payment methods.

In regards to effectively increasing bitcoins usage as a payment method, the post said that This could look like point of sale partnerships with seller and merchant services, payroll partnerships and many other types of partnerships.

The blog post concludes with a call for feedback, specifically asking for thoughts on if there are any criteria that should be adjusted, or if there are specific companies that Block should consider partnering with.

04:33

The Goldshell MINI DOGE II 420 MH/s Scrypt ASIC Miner is Now Available Crypto Mining Blog

Goldshell has completed their new BOX II home-oriented mini miners line-up with the release of the MINI DOGE II miner that is now available on their website for orders. The new Goldshell MINI DOGE II ASIC miner, much like the other BOX II devices, comes with dual operating modes 420 MH/s at 400 Watts or 355 MH/s at 260 Watts for the Scrypt algorithm. The device can merge-mine LTC and DOGE simultaneously or any other Scrypt-based crypto currency. The new Mini DOGE II miner comes in the updated slightly larger and heavier form factor compared to the older MINI DOGE PRO devices and with dual 6-pin PCI-E power connectors due to the increased power usage, just like the rest of the BOX II product line. There is a slight improvement in terms of efficiency for the higher hashrate mode where you get 0.95 Watts per Megahash (compared to 1.1 Watt per Megahash for the MINI DOGE PRO), but the more interesting efficiency wise number is in the low power mode where you get 0.78 Watts per Megahash in terms of power usage.

The new MINI DOGE II Scrypt ASIC miner is available for order at a price of $495 USD from the official Goldshell website, the price does not include shipping and taxes and it is for a WiFi equipped model). Expected date for the orders to start shipping is said to be before March 13, so in about two weeks. Do note that the official specs, just like with other BOX II devices are wrong in terms of the actual size cited by Goldshell, the devices are slightly larger and heavier compared to the previous PRO models!

Official Goldshell MINI DOGE II Specifications:

Default Hashrate Mode: 420 MH/S 5%

Default Hashrate Power: 400 W 5%

Low-Power Mode: 335 MH/S 5%

Low-Power Mode: 260 W 5%

Operating Temp: 0~35

Dimension: 178mm*150mm*84mm

Noise 35 dB

Connection Port: Ethernet/Wi-Fi

Net Weight: 2.3...

03:00

Fixing The Incentives: How Fiat Funds National Corruption Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Governments with the power to print money on a whim can avoid accountability and pursue corrupt agendas.

This is an opinion editorial by Jimmy Song, a Bitcoin developer, educator and entrepreneur and programmer with over 20 years of experience.

In the first two parts of this series, I wrote about the individual-level incentives and company-level incentives of fiat money. The individual-level incentives made personal lives have much higher time preferences through ubiquitous debt and lack of savings vehicles. The company-level incentives made communal life much more zombie-like and artificial through unnaturally-large companies that have replaced our families.

In this essay, I'm exploring the incentives at the nation-state level, where fiat money has perhaps its greatest effect. The power of fiat money gives governments the ability to become more authoritarian. Not only do we get a welfare/warfare state, but we also get a surveillance state, a police state and militaristic, corrupt tyrannies. The siren song of Marxism, of positivist law and an authoritarian vision are some of its rotten fruits. The unprecedented destructive power of governments in the last 100 years can be laid squarely at the feet of fiat money. Government authority and power have expanded more than the average American's waistline and the consequences have been just as deadly.

With Great Power Comes Great Responsibility

The central control of money is an enormous prize, like the Infinity Gauntlet of Marvel fame, giving those in power the ability to steal the wealth of their nations at will. This isn't obvious at first because the mechanisms of central banking don't make this monetary power dynamic easy to understand. Central banking is thus very attractive to governments and pretty much all fiat money since the 20th century has been of this type.

The main beneficiary of this obscured ability to print is the government that can run deficits on its budget. This was not the de facto practice historically as taking on debt under sound money is very expensive. Free market interest rates usually hover around 5.6% or higher, depending on the economic circumstances and credit worthiness. Taking on debt under sound money generally means really having to tighten budgets or raising taxes later, neither of which are popular. There's an opportunity cost to spending that's inherent in sound money that more or less disappears under fiat money. The major budget battles in the past used to be about trade-offs of various budget items. Under fiat money, budget battles are about who will get to hand o...

00:00

How Playing Football Helped Me Understand Whats Valuable About Bitcoin Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

A former college football player reflects on the lessons inherent in the sport and how they prepared him to become a Bitcoiner.

This is an opinion editorial by Conor Chepenik, a former college football player and Bitcoin pleb.

Being part of a team can provide valuable experiences that extend well beyond the sport or activity that called for its formation. For me, this was exemplified in college when a teammate introduced me to Bitcoin in 2017. Watching the documentary Banking On Bitcoin convinced me that decentralization is an important aspect of any financial system. Little did I know that this introduction would change my life.

After watching the documentary, I diversified my investment portfolio by purchasing various cryptocurrencies on Coinbase. Although I initially recognized the irony in using a third-party exchange to purchase a currency that eliminates the need for third parties, I failed to investigate further.

While exchanges that allow people to exchange fiat currency for bitcoin do have value, the true power of Bitcoin lies in its ability to provide financial autonomy to anyone. Individuals who take the initiative to spin up their own nodes and accumulate satoshis by selling their labor, goods or expertise, or those who mine Bitcoin using affordable energy, are the true pioneers of this peaceful revolution.

But it was not until I hung my football cleats up three years later that I started to understand the difference between bitcoin and every other token in the space. I was looking for something to fill the void left in my heart after my 11-year football career was over. Luckily, the Bitcoin rabbit hole was there to greet me.

Games and sports provide a way for individuals to unwind, relieve stress, improve cognitive function and foster social connections. Without my favorite game, I was lost. Football helped me get an education at a solid university, it helped me make some of the best friends I still have today and it helped me stay in shape. Ive found going down the Bitcoin rabbit hole has done all of those things as well and then some. For example, Ive started learning how to code, Ive met tons of new friends online and in person, Ive become more religious, I started a family and even tried fasting after hearing about its benefits on a Bitcoin podcast.

Its weird to think that computer code can have such a profound and positive impact on individuals and civilization as a whole. So much of computer code today is set up to polarize and separate people into echo chambers. Bitcoin does the opposite. It connects complete strangers and allows them to barter and exchange value without any third party. The computer code is completely open source, meaning people from around the world can work on a decentralized financial system together. This is the key, b...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 01 March

08:13

Salvadoran Bitcoin Education Program Is Launching A New Curriculum In English Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Mi Primer Bitcoins new diploma program is set to expand opportunities for learning about Bitcoin in high schools that adopt it.

Mi Primer Bitcoin, a Bitcoin education program based in El Salvador, has announced a new and improved diploma program in English.

According to Dalia Platt, head of curriculum for Mi Primer Bitcoin, the aim is to change the way people learn about Bitcoin. The goal is to make the course interactive, fun, creative, accessible and easy to understand for all, using examples that can reach and impact every corner of the world.

The student workbook shared with Bitcoin Magazine shows topics ranging from What is Money? to Navigating Scarcity in a Growing Economy, and more.

According to Platt, the organization has seen exponential growth. We have educated more than 10,000 students this year, which is 25 times more than last year, she said. As the first Bitcoin nation, El Salvador has the unique opportunity to lead the way in Bitcoin education.

The program, first covered by Bitcoin Magazine in June 2022, launched with more than 35 high school students receiving their Bitcoin diplomas. Since then, the educational mission of Mi Primer Bitcoin has not changed. Platt describes how she Believes that our new Diploma Program has already played a significant role in achieving [leading Bitcoin education] and we are continually enhancing the course by incorporating the feedback we receive from current and past students as well as from the teachers.

Bitcoin education is an essential part of adoption throughout the world. Without proper knowledge both in relation to the current workings of the monetary systems of the world, and the new protocol that Bitcoin offers, one cannot properly make the decision to adopt Bitcoin. Only after learning about money as it is, and money as it could be, is the full potential of Bitcoin unveiled. Programs like Mi Primer Bitcoin offer this education and learning in order to unlock that potential.

05:58

Bitcoin Core Dev Luke Dashjr Doesnt Want His Name On Ordinal Projects Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

The developer has taken to Nostr to explain why any NFT project using his name does not have his authorization.

Prolific Bitcoin Core developer Luke Dashjr has publicly declared his disavowment of any Ordinal project associated with his name.

In a post on the decentralized social media platform Nostr, Dashjr clarified his involvement in the projects, saying that I have not consented to the use of my code or my name for this purpose. Instead, 3rd parties are marketing my name and my code for their own monetary gain.

Dashjr also noted that the sellers of the NFTs have reached out to him in what he interprets as a bribe, writing that The public should also be aware that the seller and/or auction site offered me a donation of 90% of the auction proceeds should I choose to accept it. I feel this is a clear attempt to: (1) bribe me into silence; and/or (2) obtain my consent after the fact. I will not accept such payment at the expense of the public who are being misled. I will not accept any such donation.

The Core developer has previously expressed his dislike and frustration with the Ordinals project, calling it spam and an attack on Bitcoin.

Dashjr expressed his strong desire for the proceeds of the purchase to be refunded to the buyer. He concluded with a message addressing both his situation and what he feels may impact other figures in the Bitcoin space, saying I felt obligated to speak out, not just for myself, but for other Bitcoin devs who are being placed in similar situations. The amount of money we have been offered as donations for acquiescing to what is taking place is considerable. I do not condone it. I do not consent to the use of my name or code for this grift. I want the public to be aware of where I stand.

I want to do whatever I can do to limit the damage which will inevitably be caused by this confusing and misleading behavior.

The post may be a sign of necessary conversation in regards to rights and ownership of what is being uploaded to the Bitcoin blockchain via the Ordinals protocol.

03:53

Worlds Biggest NFT Company Yuga Labs Introduces First Bitcoin Ordinals Collection Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

The largest NFT creation firm will host their first Bitcoin Ordinals project, just as the network passes 200,000 inscriptions.

The creators of CryptoPunks and Bored Ape Yacht Club have introduced their first Bitcoin Ordinals NFT collection.

According to a blog post by Yuga Labs, the collection, titled TwelveFold, is an Original and experimental 300-piece generative art collection inscribed onto satoshis that will live on the Bitcoin blockchain.

The pieces appear to be randomly generated bubble-like creations that explore the relationship between time, mathematics, and variability.

TwelveFold is a base 12 art system localized around a 12x12 grid, a visual allegory for the cartography of data on the Bitcoin blockchain, the blog post reads. The collection includes highly-rendered 3D elements as well as hand-drawn features which serve as an homage to the ordinal inscriptions currently done by hand.

Yuga Labs quickly ascended to the top of the NFT market due to the success and massive popularity of their flagship projects. A March 2022 seed round at the height of the NFT craze placed the value of the company at $4 billion.

All of these choices are a departure from whats expected from Yuga, the blog post reads. But, you know. Fuck doing expected things.

Yuga Labs entry into the Bitcoin marketplace could potentially

indicate a new perception of Ordinals as a platform for the highest

levels of NFT creation. The ability for NFTs to inherit the

attributes of Bitcoin have brought them from the realm of third

parties and centralized databases to the immutable, decentralized

realm of Bitcoin.

Ordinals and inscriptions brought NFTs to Bitcoin, allowing content, such as images, videos and HTML to be included in a Bitcoin transaction and assigned to an individual satoshi. More than 100,000 collectibles were inscribed within the first three weeks of Ordinals being introduced. Now, Bitcoin full nodes host more than 200,000 inscriptions, a testament to the popularity of adding images to Bitcoin.

00:00

Why I Sold My House To Buy A Bitcoin Dip Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

After realizing that taking out a home loan meant his property was never really his, a military member sold his house to buy bitcoin instead.

This is an opinion editorial by Mickey Koss, a West Point graduate with a degree in economics. He spent four years in the infantry before transitioning to the Finance Corps.

I actually started this article nearly a year ago and had abandoned it, until the idea was reinvigorated through a Twitter Spaces with Toxic Happy Hour. When hearing @publordhodl speak about wealth taxes there, the implications suddenly slapped me across the face:

Wealth taxes and property taxes mean that you never truly own anything. Ever. Maybe thats the point.

You Already Own Nothing, You Just Dont Know It Yet

Back in 2018, my wife and I decided to leverage our VA home loan benefit to purchase a home at our new duty station. The home was in a nice pocket of a low-income area, so the price would allow us to rent the home after leaving to try and build some wealth and cash flow.

Fast forward two years: We were met with an unconscionable black swan event, and Im not talking about COVID-19. The event Im alluding to were the eviction moratoriums that were passed hastily during that period.

Through luck and happenstance, our tenant remained in place and kept paying rent, but had they stopped, it could have meant financial disaster. The message was clear and the precedent was set: I no longer had rights to my own property. We worked diligently to sell the home, eventually offloading it through an off-market deal to another investor, and we used the proceeds to buy that beautiful, glorious bitcoin price dip in 2021.

Came For The PGU, Stayed For The FGU

Like many in the military and the middle class alike, home ownership is an essential piece to building long-term wealth for me. For military folks especially, the frequent moves makes this difficult to do without choosing properties that can be rented out after you move.

I see the risks, however, as having increased exponentially after what happened in 2020. I dont think its a viable strategy anymore.

Furthermore, even if we were to pay off properties and own them outright, we would still owe taxes every year, and whats to stop another rent moratorium from going into effect? Or worse, a wealth tax? It really got me...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 28 February

23:30

Short history of altcoin miners Altcoins

Altcoins have become increasingly popular in recent years as an alternative to traditional cryptocurrencies like Bitcoin. However, altcoins would not be possible without the development of altcoin miners. In this article, we will explore the history of altcoin miners and how they have played a crucial role in the growth of the altcoin market.

Altcoins, or alternative cryptocurrencies, are any digital currency other than Bitcoin. Altcoins were created as a response to the limitations of Bitcoin, such as slow transaction times and high fees. Altcoins are often designed to address a specific problem or provide a unique feature that Bitcoin does not offer.

The first altcoin, Namecoin, was created in 2011. Namecoin was designed to be a decentralized domain name system, allowing users to register and manage domain names without relying on centralized authorities like ICANN. Namecoin used a new proof-of-work algorithm called merged mining, which allowed miners to mine both Bitcoin and Namecoin simultaneously.

Merged mining was a significant breakthrough for altcoin miners, as it allowed them to earn rewards for mining multiple cryptocurrencies at the same time. This helped to incentivize the growth of altcoins and led to the creation of many new altcoins in the years that followed.

In 2013, the first scrypt-based altcoin, Litecoin, was created. Scrypt is a memory-hard algorithm that was designed to be more resistant to ASIC (application-specific integrated circuit) miners, which are specialized mining devices that are much more efficient than standard CPUs or GPUs. Litecoin became very popular among altcoin miners because it could be mined with standard hardware, making it more accessible to hobbyist miners.

The popularity of Litecoin helped to kickstart the altcoin mining industry, and many other scrypt-based altcoins were created in the years that followed, including Dogecoin, Feathercoin, and Novacoin.

In 2014, a new type of altcoin mining was introduced with the creation of the X11 algorithm. The X11 algorithm uses a series of 11 different hashing functions, making it more secure and energy-efficient than other mining algorithms. X11 quickly became popular among altcoin miners and was used in the creation of many new altcoins, including Dash, Startcoin, and XCurrency.

Since the early days of altcoin mining, there have been many advancements in mining technology. Today, there are many different types of altcoin miners available, ranging from standard CPUs and GPUs to specialized ASIC miners. Some altcoins, like Monero, have even been designed to be ASIC-resistant, making them more accessible to hobbyist miners.

Altcoin mining is an important part of the altcoin ecosystem, as it helps to secure the network and process transactions. However, it is also a highly competitive and energy-intensive process. As the altcoin market continues to grow, there are concerns about the environmental impact of...

06:57

Bitcoin Policy Institute Announces One-Day Summit In Washington, D.C. Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

The Bitcoin Policy Institute will host conversations dedicated to exploring Bitcoin at this invite-only event.

The Bitcoin Policy Institute, a think tank dedicated to Bitcoin research, activism and education, has announced the Bitcoin Policy Summit taking place April 26, 2023 in Washington, D.C.

The summits website describes the event as a one-day, invite-only policy conference exploring Bitcoin as a strategic opportunity for the United States.

Speakers in attendance come from a variety of professional and political backgrounds. Headliners include U.S. Senator Cynthia Lummis (R-WY), House Representative Tom Emmer (R-MN), Krebs Stamos Director of Intelligence and BPI Fellow Matthew Pines, the Human Rights Foundations CSO Alex Gladstein and many other well-known figures.

Several different panels are listed on the agenda, ranging from topics fro "What Makes Bitcoin Unique Among Cryptocurrencies, and How Bitcoin Protects Human Rights," to "Bitcoin and Public Policy: Legislation and Regulation and "Bitcoin Mining: Separating Fact From Fiction.

There are also networking opportunities available for those in attendance, with allotted times for coffee, happy hour and heavy hor d'oeuvres.

Bitcoin Policy Institute describes itself as a non-partisan, non-profit think researching the impacts of Bitcoin and other emerging monetary networks BPI provides educational resources to policymakers while empowering Fellows from all over the country to conduct original academic research on cryptocurrency and tech-related issues.

Invitations for the event, to be hosted at the National Press Club Ballroom, can be requested here.

06:49

Most Americans Optimistic About Bitcoin And Crypto, Frustrated By Current Monetary System: Survey Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Most Americans would like to see their monetary system change, according to a study conducted on behalf of Coinbase.

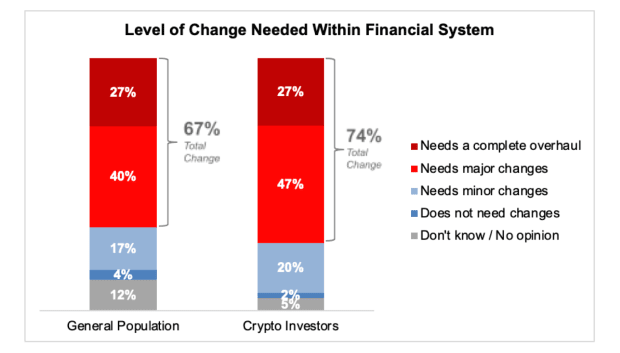

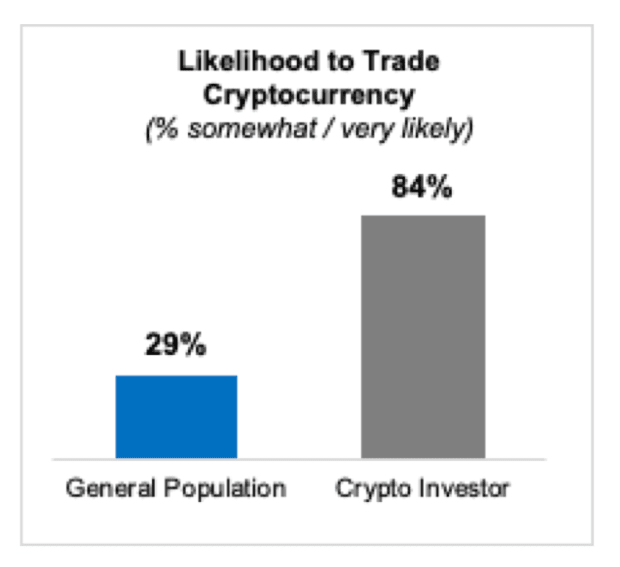

A study conducted by Morning Consult on behalf of Coinbase examined the perceptions of the global financial system and how U.S. adults and cryptocurrency investors view the future of the cryptocurrency market. It found that Americans believe the current financial system needs to be updated, and there is optimism about owning bitcoin as we head into the future.

The survey found that 80% of Americans say the global financial system unfairly favors powerful interests. In addition, 67% said that the financial system needs a major overhaul. Interestingly, younger Americans are most likely to favor cryptocurrency and view it as a worthwhile asset for the future.

With the various challenges presented over the last couple of

decades, including the 2008 financial crisis, the COVID-19

lockdowns and subsequent economic fallout, unsurprisingly, Among

U.S. adults, the top word associations with the global financial

system are expensive (34%), unfair (30%), and confusing

(30%).

20% of Americans own cryptocurrency, which has remained consistent each quarter since January 2022, the survey states. Despite the downturn in the broader cryptocurrency market as a result of various bankruptcies and failures in 2022, Americans consistently express interest in owning digital assets. Another interesting note is that current investors who already hold digital assets still hold a favorable view, with 84% likely to buy cryptocurrency over the next 12 months.

Many Bitcoiners have demonstrated...

06:49

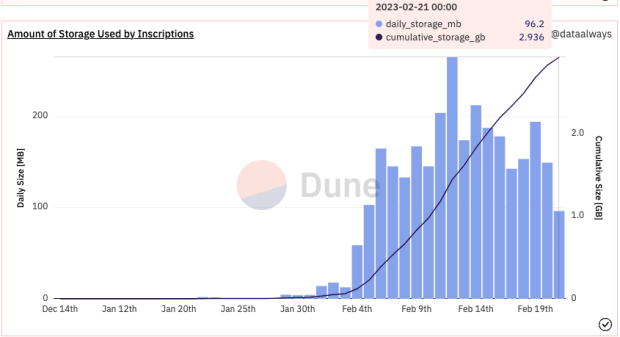

Showcasing The Bitcoin Inscriptions Craze In Six Charts Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Six insightful data sets underscore the rapid rise of interest in Bitcoin inscriptions, demonstrating their undeniable impact.

Inscribing bits of data onto the Bitcoin blockchain through Ordinals has captured the attention of cryptocurrency enthusiasts inside and beyond Bitcoin since the start of 2023.

Whether or not Bitcoin should be used for this NFT-like activity is a hotly-contested issue and the data coming from the effects of this mini Bitcoin collectives craze is intriguing. Inscriptions could be a short-lived fad, but several early data sets from the first weeks of inscription activity show tremendous interest in this new use case for the Bitcoin network. Diving in, this article provides an overview of six sets of data from the inscription mania.

Overview Of Bitcoin Inscriptions Data

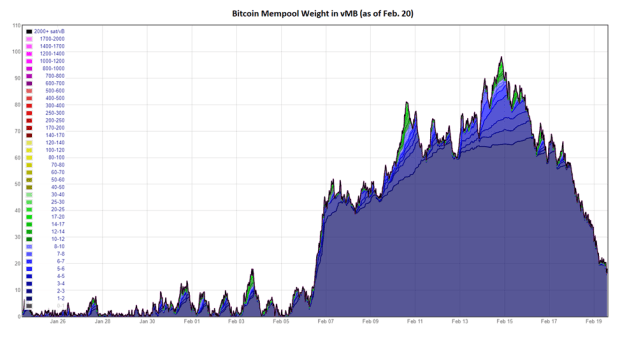

The amounts and weights of pending transactions in Bitcoin mempools around the world are a clear signal of how popular inscription transactions have been to Bitcoin users amid the ongoing mini-craze over Bitcoin NFTs. Throughout most of the current bear market cycle, pending transaction levels in Bitcoin mempools have stayed fairly low, especially when compared to the height of both the 2017 and 2021 bull markets. In fact, a Twitter bot called Mempool Alert tweets every time its mempool empties, and the tweets were posted on a consistent basis for months throughout 2022.

The mempool pending transactions visual below shows the total weight of unconfirmed transactions throughout most of February 2023. The surge in pending transactions directly correlates to the inscriptions craze, which has somewhat subsided toward the end of February.

Inscription transactions are notoriously large, and the block sizes that have come from the inscription craze prove it. For years, the sizes of Bitcoin blocks hovered just below 1.5 megabytes (MB) as the line chart below illustrates. But the vertical increase in block sizes on the far right side of the chart is due entirely to Bitcoin inscriptions.

With these Bitcoin NFTs becoming popular, blocks started being produced between 2 MB and 2.5 MB on average. Several blocks flirted with the 4 MB limit, including the giant Taproot Wizard block mined by Luxor in collaboration with Udi Wertheimer and others.

04:08

Introduction to the Best Multisig Wallets Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Bitcoin multisig wallets are a great security solution to help you keep your Bitcoin secure, private and as accessible as your require at all times

What are the best multisig wallets to store bitcoin

Your Bitcoin wallet is the access to your digital funds and should be kept secure and private at all times. Online threats like malware programs, hacks and phishing attacks are always lurking behind the screen, and so is the risk of losing your own private keys, which could lead to losing your funds with no way to recover them.

If this sounds too brutal, you should realize that the highlighted risks are real and people have lost money due to dramatic accidents. Such accidents may include leaving bitcoin in centralized exchanges that have gone bankrupt like the recent FTX or vanished to potential rug pulls, like the Canadian exchange Quadriga.

Bitcoin multisig wallets come to the rescue and represent a great security aid in a self-custody practice. Multisig wallets have existed in Bitcoin since 2012. More recently, they have acquired a stronger position in securing the digital asset with cutting-edge technology suitable for less tech-savvy bitcoiners.

In recent years weve seen DIY wallets emerging for extra security. With DIY devices, you can buy your own components and build your own device that leaves no trace and securely generates private keys. Such an approach also benefits users from countries where conventional hardware wallets are not allowed to be sold or have poor delivery services and are optimal for low-cost solutions.

For the purpose of this article, we have structured the content into two distinct sections:

- Collaborative custody wallets: whereby you use a third party to manage one of your private keys.

- Self-custody wallets: whereby you alone manage the distribution of the private keys.

Best Collaborative Multisig Wallets

In a collaborative multisig wallet, which is likely to offer 2-out-of-3 key management, you will likely have control over one private key. At the same time, the third party an exchange or a custodial company holds the second private key online and the third key offline in cold storage.

The advantage of such a solution is convenience and reliance on customer service to assist with managing the private keys if anything happens. This occurs at the expense of privacy because companies may require KYC procedures to allow customers to use their services. Another disadvanta...

02:00

BTCPay Server Adds WabiSabi CoinJoin Plugin, Giving Option For Increased Privacy For Merchants Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Merchants using BTCPay Server will now be able to protect their privacy using Wasabi Wallets CoinJoin coordination protocol.

Bitcoin payment processing software BTCPay Server has added a CoinJoin plugin for its merchants, allowing them to retain privacy while managing their stores. Stores that activate the Wasabi Wallet-based WabiSabi CoinJoin coordination protocol will be able to automatically CoinJoin all of the bitcoin they receive.

A CoinJoin is when two or more people combine their transactions into one transaction, in such a way that it is unclear who owns which coin after the transaction.

The plugin, developed by Andrew Camilleri, also

offers a payment batching in CoinJoin feature, allowing users to

pay addresses directly within a CoinJoin transaction. This will

save block space and enhance privacy compared to making a payment

in two steps, states the press release sent to Bitcoin

Magazine.

The BTCPay Server plugin also includes a coin selection interface

that lets merchants spend their coins based on their gained

anonymity scores. By using the WabiSabi CoinJoin protocol,

merchants can perform arbitrary amount CoinJoins rather than fixed

denomination CoinJoins, reducing the amount of non-private change

users receive and making payments inside the CoinJoin possible.

"BTCPay Server is the most sophisticated merchant payment processing software for bitcoin. It only made sense that it would include an optional CoinJoin plugin with the most sophisticated privacy-enhancing tool for Bitcoin," said Max Hillebrand, Wasabi Wallet contributor and CEO at zkSNACKs. Users can access a dashboard to assess the level of privacy of their wallets and the details on the current CoinJoin transaction they are participating in, and gain additional insights and control with coin selection in and out of CoinJoin transactions.

All BTCPay Server merchants can now utilize the new CoinJoin feature. They can choose to CoinJoin for a fee with a coordinator provided by zkSNACKs, and all BTCPay Server admins can spin up their own CoinJoin coordinators using their own terms, built upon Wasabi Wallets WabiSabi CoinJoin protocol. If users run their own coordinator, the BTCPay Server Plugin also offers an optional revenue-sharing feature that donates a percentage of proceeds to the HRF and OpenSats foundations.

00:00

Dont Trust, Verify: Fixing The Problems With Academic Research On Bitcoin Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

To date, much of the academic research on Bitcoin has lacked high-quality data and rigorous review. Its time to fix that.

This is an opinion editorial by Rupert Matthews, a lecturer at the Nottingham Business School.

Even though the Bitcoin network is open source and accessible to anyone with an internet connection, the Bitcoin community can at times be viewed as closed to new ideas, with many stories of people excluded as a result of promoting and supporting non-Bitcoin activities.

At the same time, the benefits of Bitcoin are immediately apparent to those within the community, who also need to support the sharing of information on Bitcoin to no-coiners in order to support wider adoption. Unfortunately, broader perceptions of Bitcoin in the media and the old guard of Wall Street have meant that the education process can be an uphill battle that must first dispel mistruths before actual education can begin.

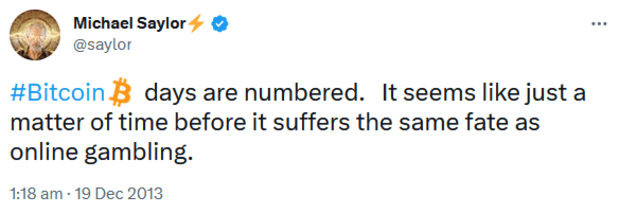

Please remember, even one of our most ardent supporters was once a no-coiner too:

It is also worth remembering, no-coiners cannot all be Michael Saylors, and are not all lucky enough to have close personal friends (thanks Eric Weiss) willing to take the time to clearly explain the concept to us, or the personal motivation to spend thousands of hours educating ourselves. We likely needed several touch points, combined with some base understanding to create the mental curiosity to ask: What is money? And where does money come from?

Saifedean Ammous works are some of the best, most widely-referenced sources for answering these questions, but people still need to be willing to read the 274 pages of The Bitcoin Standard to access them.

The problem is then, not only whether we have the voices to promote education, but also whether we have enough voices to both compete against those selling their assets of choice from Wall Street, but also against uninformed journalists (who are often unable to own the assets they report on), and are greater in number or have wider audiences.

Unfortunately, the sources of conflicted views of Bitcoin dont end with Wall Street speculators and journalists. Nic Carter, in his critical review of the recent White House...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 27 February

22:00

Mash Introduces Ghost Checkout, Enabling Bitcoin Payments Without An Account Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Users will now be able to use the payment service to instantly support content sources using Bitcoin without registering an account.

Mash, a monetization service powered by Bitcoins Lightning Network, has announced that people will no longer have to create an account on the service in order to utilize it.

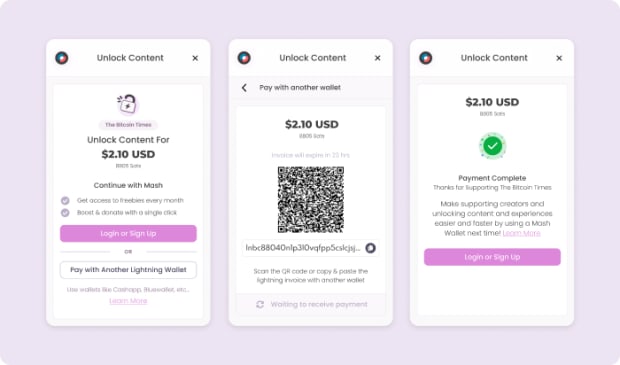

According to a press release sent to Bitcoin Magazine, Weve extended a large number of our widgets to allow users to donate and spend without creating an account on Mash. You have the additional option to scan and contribute with another lightning wallet for a donation, to purchase something and more. You can use any lightning powered wallet including CashApp, Strike, Breeze and Zebedee.

Anyone can now go to sites that have Mash integrated and utilize the feature, by selecting "pay with another lightning wallet," scanning with a Lightning wallet, and then confirming the transaction.

The feature has also been extended to the Mash button so that you can donate easily without being logged in.

There are multiple options immediately available, including a regular Lightning invoice, LN-URL QR code that you can and choose the amount in the other wallet, and a Lightning address that all creators and builders get, describes the release.

Some of the benefits of integrating with Mash, according to the release, include one-click boosts and payments, a fluid mobile experience and auto-contributions.

20:00

Trezor Now Controls Its Silicon Chip Supply Chain Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

The Bitcoin hardware company has begun manufacturing its own chip wrapper for the Trezor Model T.

Trezor, a Prague-based Bitcoin hardware company, has announced that it has taken control of its silicon chip supply chain.

According to a press release sent to Bitcoin Magazine, the company has achieved this by facilitating the manufacture of its own key component, the chip wrapper, for its flagship product, the Trezor Model T. The new chip wrapper improves device security and significantly shortens lead times for mass production, the release states.

With the silicon chip supply chain under constant geopolitical pressure, securing the manufacturing of this important component is a source of confidence in the ability for Trezor to continue producing its products.

tpn Uherik, CFO at Trezor, commented that The twists and turns in demand for hardware wallets and the silicon supply chain disruption that weve seen over the past few years was a problem that we needed to solve. By unpacking the process, identifying areas where we could take control, and collaborating with our partners in new ways, weve managed to make the manufacturing as agile as it can be.

He added that It also adds more design freedom for future products, helping us to sustain our leadership in the increasingly competitive hardware wallet space.

SatoshiLabs, the company behind Trezor, also announced last year the development of an open-source chip for usage in Bitcoin hardware. Just recently, the company detailed that the initial testing on the first chip, TROPIC01, had been completed, with expectations of continued testing throughout 2023.

17:00

Warning! Fake AI Tokens | This Week in Crypto Feb 27, 2023 99 Bitcoins

The post Warning! Fake AI Tokens | This Week in Crypto Feb 27, 2023 appeared first on 99 Bitcoins.

Coinbase launches a new blockchain, the IMF sends mixed signals on cryptos, and watch out

Warning! Fake AI Tokens | This Week in Crypto Feb 27, 2023 Read More

00:00

Long Form: Why Detailed Narratives Are Necessary For Telling Bitcoin Stories Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

Conveying the real implications of Bitcoin to audiences requires long-format storytelling with a detailed, comprehensive narrative style.

This is an opinion editorial by Pierre Corbin, a documentary producer and director.

Bitcoin, the world's first decentralized digital currency, has been making headlines for over a decade. Despite its growing popularity, the technology behind Bitcoin is still largely misunderstood by the general public.

In order to increase its global adoption, it is important to build a narrative that explains the purpose and potential of Bitcoin in a comprehensive and engaging manner. This is where long-format storytelling comes in. By telling the story of Bitcoin in a thoughtful and detailed way, people are more likely to truly understand the technology and its impact on the world.

What Is Long-Format Storytelling?

Long-format storytelling is a narrative style that involves telling a story in a comprehensive and detailed manner. This style of storytelling is often used to explain complex concepts and ideas in a way that is easy to understand and engaging. In the case of Bitcoin, long-format storytelling is an essential tool for building a narrative that helps people understand the purpose and potential of the technology.

The Importance Of Storytelling For Bitcoin Adoption

The story of Bitcoin is about more than just the technology itself. It is about the values and principles that underpin that technology, such as decentralization, transparency and security. A compelling narrative can help bring these values and principles to life, making them more tangible and relatable for people. Additionally, storytelling can help to create an emotional connection to the technology, which can drive greater engagement and investment.

Another important aspect of storytelling is that it can help to demystify the technology. Bitcoin is often seen as complex and confusing to those who are unfamiliar with it. A well-told story can help to break down the technology and make it more accessible to a wider audience. By doing so, more people will be able to understand the potential of Bitcoin and how it can impact their lives.

How To Tell The Story Of Bitcoin