| IndyWatch Crypto Currency Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Crypto Currency Feed was generated at Community Resources IndyWatch. |

|

Sunday, 16 July

23:01

Enterprise blockchain: Ethereum for Business explains key use cases Cointelegraph.com News

Paul Brodys Ethereum for Business gives a basic overview of enterprise Ethereum, while providing real-world use cases of how EY clients leverage the technology.

22:34

Synthetix (SNX) Up By 35% In Anticipation Of New Decentralized Exchange NewsBTC

SNX, the native token of the Synthetix Network, has been on the rise, gaining more than 35% in the past week. The cryptocurrency continues to exhibit strong bullish momentum, having registered a positive market performance over the past few weeks.

SNXs recent price surge has been linked to the positive sentiment surrounding the Synthetix network. A few days ago, the protocol announced its plan to release a new decentralized exchange (DEX).

Synthetix Token Tallies 35% In One Week Price Overview

The cryptocurrency market experienced a jolt of positivity after the long-running battle between payments and technology firm Ripple the company behind XRP and the United States Securities and Exchange Commission (SEC) came to a positive conclusion on Thursday. US District Judge Annalisa Torres delivered a landmark judgment declaring the XRP token as non-security, thereby granting a decisive triumph for Ripple.

However, unlike other cryptocurrencies, the price of SNX barely reacted to this piece of news. The tokens value increased by a mere 5% following the announcement of the courts decision.

SNX did experience a surge of its own the following day. On Friday, July 14, the tokens price jumped by nearly 40%, touching the $3 level before retracing back to $2.5.

As of this writing, the Synthetix token is valued at $2.82, with an 8% price increase in the last 24 hours. With a market cap of $903.4 million, SNX ranks as the 47th-biggest cryptocurrency, according to CoinGecko data.

The recent increase in SNXs price is believed to have been triggered by the announcement of a new Synthetix trading product. In a blogpost released on Friday, the protocols founder Kain Warwick unveiled plans to introduce a new derivatives front-end called Infinex.

What Is Infinex?

Infinex is a new derivatives front-end to the decentralized trading infrastructure of Synthetix. The exchange is expected to be an improvement on the already-existing Kwenta, Synthetixs derivatives decentralized exchange on Optimism.

According to Kain Warwick, Infinex will remove the impediments to the growth of Synthetixs decentralized trading ecosystem. Firstly, it will address the inconvenience of acquiring sUSD, Synthetixs stablecoin, to begin trading on Kwenta. Also, it will eliminate the need to sign every action on th...

22:00

Copernicus Lost Secret: The Quantity Theory Of Money Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

This is an opinion editorial by Bitcoin Graffiti, a software developer and graffiti artist.

"Those things which I am saying now may be obscure, yet they will be made clearer in their proper place."

In the annals of history, Nicholas Copernicus is celebrated as the groundbreaking astronomer who toppled the geocentric view and unveiled the heliocentric model, placing the sun at the center of our solar system. However, there is a lesser-known facet of Copernicus' genius that remains shrouded in obscurity: his profound contributions to monetary thought.

While his astronomical achievements have captivated generations, his insights into the nature of money and its effects on economies have largely been overlooked.

As the medieval era drew to a close, marked by transformative inventions like the Gutenberg printing press and the disruptive force of gunpowder, Copernicus's groundbreaking work challenged not only the prevailing astronomical beliefs but also the accepted notions of money.

The emergence of the printing press ushered in an era of unprecedented knowledge dissemination, gradually eroding the information monopoly of the Catholic Church. Concurrently, the widespread adoption of gunpowder rendered knights and their armor powerless, signifying the decline of the feudal system. Amid this backdrop of change, Copernicus emerged as a visionary, his mathematical calculations eventually proving that the Earth was not the center of the universe.

While we may look back on our geocentric ancestors and marvel at their supposed ignorance, we must acknowledge that most of us are quite incapable of proving the heliocentrism ourselves. We generally accept the current belief. If that is true, mustn't there be obvious things we could be missing today? What if our assumptions about money, the lifeblood of economies, are flawed as well and the study of economics is still in its infantile stage? Perhaps, just as Copernicus shattered the prevailing astronomical narrative, we are on the cusp of an intellectual revolution that will expose the shortcomings of contemporary monetary belief.

It is here, amid these profound reflections, that Copernicus' hidden expertise in monetary matters resurfaces. Unbeknownst to many, this visionary mind not only revolutionized our understanding of the heavens but also made lasting contributions to the field of monetary thought.

19:00

A new age in investing: The transformative power of asset tokenization Cointelegraph.com News

From real estate to franchising, and from renewable energy to Hollywood, tokenization has the potential to transform the way we do business.

16:23

Senator Lummis urges clear crypto regulations after XRP ruling Cointelegraph.com News

The outcome of the case could establish a precedent that shapes the regulatory landscape for digital assets within the United States.

16:17

US dominates crypto startup funding in Q2: Report Cointelegraph.com News

United States-based crypto startups attracted 45% of all venture capital funding invested in the crypto industry, followed by the United Kingdom (7.7%) and Singapore (5.7%).

12:12

SEC could be waiting years to file appeal in Ripple case Brad Garlinghouse Cointelegraph.com News

According to Ripple CEO Brad Garlinghouse, an appeal by the U.S. Securities and Exchange Commission would only reinforce Judge Torress decision that XRP is not a security.

12:00

Stablecoin TrueUSD To Be Fully Controlled By Asian Owner NewsBTC

In todays news, the prominent stablecoin TrueUSD with the ticker TUSD is now undergoing a management change. According to a thread this morning by the projects official Twitter handle, Archblock Inc., the current TUSD operator, has begun the transfer of total control of Token to its Asian-based owners, Techteryx Ltd.

Techteryx Finally Assumes Control Of TrueUSD

Back in December 2020, Techteryx acquired ownership of TUSD but hired Archblock to keep maintaining the stablecoins operations. And for the last two years in which Archblock remained TUSDs operator, Techteryx claims to have been focusing on expanding the tokens foreign use cases in the global markets.

Related Reading: BUSD Market Cap Plunge Of 80% Raises Concerns Of Impending Collapse

However, Archblock has now commenced the transfer of control yesterday, July 13, marking the end phase of TUSDs international transition. Upon completion, Techteryx will reportedly assume full management of all aspects of the stablecoins operation.

These controls will include mining and redemptions, customer onboarding and compliance, conservation of fiat reserve, and maintenance of banking and fiduciary relationships.

During the transition period, Archblock will continue to support the US-based TUSD users, with Techteryx stepping in with the necessary guidance and further updates.

Prior to todays news, TUSD has attracted some interest especially following Binances recent moves with the stablecoin. On June 21, the cryptocurrency exchange announced the launch of a TUSD zero-maker fee promotion for spot and margin trading pairs beginning from June 30.

Interestingly, Binance had minted $1 billion worth of TUSD on the Tron network a week before making that announcement becoming the largest holder of the token.

Related Reading: Stablecoin Market Share Dwindles As USDC And BUSD Supply Deplete

At the time of writing,...

08:00

Why Ripples Victory Against The SEC May Be Short-Lived: Legal Expert NewsBTC

The news of Ripples recent partial victory against the SEC after a legal battle spanning almost three years sent a ripple of joy around the entire crypto industry. However, according to a legal expert on Twitter, Lawyer Bryan Jacoutot, the victory might be short-lived as SEC has enough grounds to appeal the decision and drag this thing out for a lot longer.

The SECs Lawsuit Against Ripple Labs

The SEC filed a lawsuit against Ripple Labs in December 2020, alleging that Ripple had conducted an unregistered securities offering worth over $1.3 billion through the sale of XRP. According to the SEC, XRP is a security under federal securities laws. But the court determined on June 13 that the random programmatic sale of XRP to regular investors does not constitute the sale of an unregistered security under Howey.

However, sales to institutional investors fall under Howey, which is used in the United States to determine whether a transaction qualifies as an investment contract. In this case, the Court found that the buyers couldnt know who was selling them the XRP, unlike the institutional investors who would expect Ripple Labs to use the capital for the betterment of the Ripple ecosystem.

According to Jacoutot, the Courts reasoning is weak and Howey was misapplied in the case. The Court reasoned that regular investors bought XRP fully knowing that it is subject to the general cryptocurrency market trends, especially secondary sales of XRP tokens. However, Jacoutot believes those buying XRP would have also expected to make a profit from the efforts of Ripple Labs.

The attorney also made a case of the Ethereum Foundation, as everyone who took part in the pre-sale of ETH knew they were buying from Ethereum Foundation. When looking at the XRP ruling in a similar manner, this would mean institutional investors of the ETH presale also bought unregistered securities.

What Does The Ruling Mean?

According to Jacoutot, the ruling opens up a few loopholes that can be exploited. In a tweet by attorney Joe Carlasare on Twitter, it explains that the logic of the ruling leaves an opening that can be used to lawfully launch a pyramid scheme. In this case, profits from the programmatic sales to retail investors can be distributed to institutional investors.

Ripple CEO Brad Garlinghouse has...

07:13

XRP is not a security, Celsius CEO arrested on criminal charges, and more: Hodlers Digest, July 9-15 Cointelegraph.com News

Ripple Labs has partially defeated the SEC in court, triggering a price increase for XRP. A billion-dollar fine was imposed on Celsius Network by the FTC, and its CEO was arrested for fraud.

05:35

Ark Invest Sells Over $50 Million Worth of Coinbase Shares Amidst Stock Rally NewsBTC

Cathie Woods investment firm, Ark Invest, has made significant moves in its holdings of Coinbase shares, selling over $50 million worth of shares as the cryptocurrency exchanges stock continues to surge.

This marked the second time in a week that Ark Invest reduced its stake in Coinbase, reflecting its active management approach amid a backdrop of regulatory developments and industry optimism.

At the same time, Ark Invest has been actively investing in other notable companies, including Meta Platforms and Robinhood.

Ark Invest Cashes In on Coinbase Rally

Ark Invest, led by Cathie Wood, sold a total of 478,356 shares of Coinbase on Friday, amounting to more than $50 million. The sales were spread across Arks flagship fund, Ark Innovation ETF, which sold 263,247 shares, Ark Next Generation Internet ETF, which sold 93,227 shares, and Ark Fintech Innovation ETF, which offloaded 121,882 shares.

This decision comes on the heels of Coinbases role as a surveillance-sharing partner for several spot Bitcoin ETF applicants, including industry giants BlackRock and Fidelity. Furthermore, recent legal rulings surrounding the status of the cryptocurrency XRP have added to the overall industry optimism.

However, despite the sales, Ark Invest remains the second-largest owner of Coinbase shares, holding a 6.30% stake.

Looking To The Future With Meta Platforms and Robinhood

While reducing its Coinbase holdings, Ark Invest has also been actively investing in other crypto-adjacent companies. The firm initiated purchases of shares in Meta Platforms (formerly Facebook) and Robinhood. In June, Ark Innovation ETF acquired 69,793 Meta shares, while Ark Fintech Innovation ETF purchased 111,843 shares of Robinhood.

Additionally, the Ark Next Generation Internet ETF increased its holdings with 12,559 Meta shares and 169,116 Robinhood shares. These strategic investments reflect Ark Invests ongoing strategy to navigate the evolving digital asset market.

Ark Invests decision to trim its Coinbase holdings after significant acquisitions during market volatility and regulatory challenges demonstrates a calculated approach to secure profits amid the stocks impressive rally this year and indicates a calculated effort to secure profits during the stocks rally.

Also, it demonstrates the firms commitment to diversifying its portfolio for long-term growth potential, as evidenced by its investments in Meta Platforms and Robinhood.

As the crypto market continues to evolve, Ark Invests actions will be closely watched by...

05:24

Multichain was a big blow, says Andre Cronje as Fantom TVL slumps Cointelegraph.com News

Fantoms TVL dropped from over $364 million in early May to about $70 million on July 14. At its peak in 2022, Fantoms TVL topped $7.5 billion.

02:10

Ron DeSantis vows to ban CDBCs in the US if elected president Cointelegraph.com News

Speaking at the Family Leadership Summit on July 14, DeSantis promised to ban CBDCs in the United States if elected president.

01:00

Project roadmap or token price Which is most important? Cointelegraph.com News

Content creator KryptosChain explains why a projects roadmap and token price are important to its success, as well as the upgrades to the Polkadot ecosystem that excite him most.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 15 July

23:09

Entity representing Binance customers seeks compensation Cointelegraph.com News

The mysterious entity called Eeon seeks compensation from Binance and the U.S. SEC, equivalent to 20% of the daily value of withheld funds per customer, totaling $1000 per day.

23:01

AI signals vs. human intuition: Decision-making in crypto trading Cointelegraph.com News

AI and human intuition together can make for powerful trading tools.

22:00

Moral Compass: The Political Spectrum And Our Understandings Of Bitcoin Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

This is an opinion editorial by Dea Rezkitha, an Indonesian Bitcoin educator and podcast host.

In politics, individuals are often grouped into left and right wings, but the complexities go well beyond this simple dichotomy. To gain a deeper understanding of peoples beliefs and values, and ultimately how these will inform their outlook on Bitcoin, it is crucial to consider their social views as well. This is where a political compass comes into play, serving as a valuable tool for analysis.

What Is A Political Compass?

The political compass is a graphical representation of political ideologies that helps categorize individuals or groups based on their views on two main axes: economic policy (left-right) and social policy (authoritarian-libertarian). It provides a more nuanced understanding of political ideologies beyond the traditional left-right spectrum.

You can easily take the political compass test at this link.

The political compass allows for a more comprehensive understanding of political ideologies by incorporating both economic and social dimensions. It recognizes that political views cannot be easily reduced to a simple left-right spectrum and acknowledges the varying degrees of government intervention and social control that different ideologies advocate for.

The left-right axis reflects a spectrum of economic policy preferences. On the left side, you find ideologies that generally advocate for greater government intervention in the economy and more equitable distribution of wealth and resources. These ideologies may support policies such as progressive taxation, social welfare programs and government regulation of industries. They often prioritize social justice and reducing inequality.

On the right side, you find ideologies that favor less government intervention in the economy and emphasize individual freedom and free markets. These ideologies tend to support lower taxes, limited government regulation and free trade. They believe that economic prosperity is best achieved through minimal government interference and individual initiative.

The authoritarian-libertarian axis represents social policy preferences and the degree of government control over personal freedoms. Authoritarian ideologies advocate for a strong central authority that exercises control over various aspects of society. They may support strict law enforcement, censorship and limitations on individual rights in the name of maintaining social order and stability.

Libertarian ideologies, on the other hand, emphasize individual liberty and limited go...

21:40

Dogecoin Engagement Fails To Impress, Raising Concerns About Broader Interest NewsBTC

Is Dogecoin (DOGE losing its charm? Despite the impressive price rally in May, recent trends suggest a decline in engagement and investor interest. As the crypto market continues to evolve, concerns are mounting about the broader implications of Dogecoins waning appeal.

Dogecoins engagement metrics have faltered, leaving some experts wondering if the cryptos allure is wearing off. Market indicators show a decline in trading volume, with fewer transactions taking place compared to previous months.

Will this once-beloved digital currency be able to regain its momentum, or is its star beginning to fade?

Dogecoin New Addresses Stagnant

The growth of new addresses joining the Dogecoin community has hit a roadblock since May, according to a recent DOGE price report. However, on-chain data analysis reveals that this stagnation in new holders has not adversely affected the weighted sentiment associated with the cryptocurrency.

As of the latest update, DOGEs weighted sentiment stands at -0.645. This metric provides insights into the average sentiment attached to a particular cryptocurrency, taking into account the unique social volume surrounding it.

Interestingly, despite the somewhat negative value, the weighted sentiment has shown improvement from its low point of -1.99 on June 9. This shift suggests that the prevailing defeatist perception during that period has gradually shifted towards a more optimistic outlook.

Social Volume And Holder Count: A Diverging Trend

However, while the weighted sentiment demonstrates a positive trajectory, the coins social volume tells a different story. Instead of aligning with the stagnant number of holders, the social volume of Dogecoin has remained remarkably low since June 9, as per Santiments data.

Social volume measures the number of mentions and discussions...

21:34

Polygon (MATIC) Flexes Muscles In The Last Week With 27% Gain Details NewsBTC

Polygon (MATIC) has demonstrated a significant price surge in the past week, rising by 27.39%. This bullish momentum has been further reinforced by a 9.38% increase in the last 24 hours. However, in the most recent hour, the price experienced a slight decline of 1.04%. Currently trading at $0.84 per MATIC, the cryptocurrency remains 71.11% below its all-time high of $2.92.

Reasons For The Price Movement

Multiple factors have contributed to the recent price movement of the crypto. Firstly, a favorable court ruling for XRP ripple effect on market sentiment, potentially influencing the performance of other cryptocurrencies like MATIC. The courts determination that XRP is not a security has provided investors reassurance and positively impacted the overall cryptocurrency market.

Related Reading: PEPE Sees Sharp 17% Surge, But Will This Whale Spoil The Party?

Furthermore, the increased activity of decentralized applications (Dapps) on the Polygon Network has significantly driven up demand for MATIC. The networks reputation as a scalable and efficient solution for the Ethereum network has attracted numerous developers and users to build and interact with Dapps on the platform. This heightened interest in the Polygon Network has increased demand for MATIC tokens.

Additionally, the highly anticipated launch of Polygon 2.0 has generated excitement within the community. This proposed upgrade aims to enhance the functionality and scalability of the Polygon Network, allowing for the support of multiple chains without compromising security. If successfully implemented, Polygon 2.0 could further solidify MATICs position as a leading blockchain solution, potentially attracting more investors and driving higher prices.

Expectations For Polygon

Looking ahead, Polygon holds promising prospects for further growth and development. With a total value locked (TVL) of $1 billion on the Polygon Network, the platform has established itself as a prominent second-layer scaling solution for Ethereum. The increasing TVL, which has grown from $878 million in the previous month, indicates...

20:50

ARK Invest sells more Coinbase shares, eyes Meta platforms, Robinhood Cointelegraph.com News

Cathie Woods ARK Invest is actively investing in Meta Platforms and Robinhood Markets shares.

19:56

Synthetix takes on counterparty risks with Infinex derivatives exchange Cointelegraph.com News

The upcoming exchange will cater to novice and experienced traders by offering features similar to centralized exchanges.

19:28

BNB Chain Inks New Record With Soaring User Activity A Boost For Price? NewsBTC

BNB Chain, the blockchain platform powering the Binance ecosystem, has recently emerged as a formidable force in the crypto world, surpassing its competitors in terms of daily active users. This surge in user engagement has coincided with a surge in the value of the BNB token, which has experienced a steady increase of over 5% within a single week.

As BNBs daily active users continue to soar, one cant help but question the overall impact of this unprecedented growth. What lies behind BNBs ability to outshine its rivals and attract a growing user base? Is there a hidden catalyst propelling its value upwards?

Moreover, as these metrics diverge from the norm, skeptics begin to raise valid concerns about the sustainability and potential risks associated with BNBs rise.

BNB Chain Surpasses BTC, ETH In Daily Active Users

In the ever-evolving landscape of blockchain technology, BNB Chain has recently achieved a significant milestone, surpassing renowned chains such as Bitcoin (BTC) and Ethereum (ETH) in terms of daily user activity. According to a BNB analysis, the chain secured the second position, solidifying its position as a formidable player in the crypto world.

Token Terminals data also revealed that BNB Chain boasts an impressive count of over 1 million daily active users, a testament to the platforms growing popularity and appeal. This notable achievement is even more remarkable considering the longstanding dominance of Bitcoin and Ethereum, which have traditionally held the top positions in the cryptocurrency market.

The BNB token has also made waves in the market. Currently priced at $248.78, it experienced a slight setback with a 3.5% slump in the past 24 hours. However, the token quickly bounced back with a decent 5.4% increase in the last week.

...

19:07

5 peer-to-peer (P2P) lending platforms for borrowers and lenders Cointelegraph.com News

Discover five platforms Aave, Compound, MakerDAO, dYdX and Fulcrum that are transforming lending and borrowing through decentralization.

18:20

SEC accepts BlackRocks Bitcoin ETF application, signaling regulatory review Cointelegraph.com News

The SECs acknowledgment indicates the commencement of the official review process for BlackRocks ETF proposal.

17:21

AVAX Tallies 23% In The Past Week, Buyers Accumulate For Potential Breakout NewsBTC

Avalanche (AVAX), the native token of the Avalanche blockchain, has witnessed a notable price surge of 27.39% over the past seven days, capturing the attention of traders and investors. Currently facing strong resistance at the EMA50 daily level, AVAX is showing promising signs of potential bullish momentum. As buyers accumulate AVAX anticipating a breakout, optimism grows within the market.

As of the latest data, Avalanche is trading at $15.45 per AVAX, showcasing impressive price growth within the past week. With a circulating supply of 345,845,505.008 AVAX, the tokens total market capitalization stands at $5,294,894,681.68. Furthermore, AVAX has experienced a substantial surge in trading volume, which has increased by $2,091,996,941.63 in the last 24 hours, marking a significant 381.96% rise. In the past day, approximately $547,703,576.77 worth of AVAX has been traded.

AVAX: Strong Resistance And Accumulation

The EMA50 daily level has emerged as a formidable resistance point for the coin, presenting a considerable challenge for buyers to overcome. However, buyers increasing accumulation of AVAX indicates a positive sentiment and a belief in the tokens potential to breach the resistance level. Traders have noticed similarities between AVAX and other successful cryptocurrencies, drawing comparisons that suggest a potentially significant price surge.

Related Reading: XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Looking at the technical indicators, its relative strength index is at 65 in the neutral zone between the oversold region of 50 and the overbought region of 75. The Moving Average Convergence/Divergence (MACD) is currently in the buy zone which is a bullish signal. In addition, the histogram bars are green and signal that a bullish trend is ahead and if the bulls persist, the crypto is likely to have a sustained uptrend in the coming days

Growing Investor Interest And Bullish Sentiment

The ongoing accumulation of AVAX demonstrates a growing interest and confidence among investor...

16:10

Nifty News: The Flash goes Web3, Yuga Labs still working hard on audacious Otherside project and more Cointelegraph.com News

The Sandbox added a new major IP to its virtual world, a portfolio management startup raised $3.6 million and The Flash is getting NFTs.

15:45

Figuring Out "IndyWatch Feed World"

The best Digital currency firm that will deliver the best

Cryptocurrency trading is the one that you do have to select when

the time comes when you do require their cryptocurrency trading.

There are a lot of Cryptocurrency

trading that are offered by different digital currency firms and

hence makes it a little bit difficult for one to settle. However,

for one to be certain that he or she has settled for the most

suitable Digital currency firm, then he or she has to factor in the

points below.

How much he digital currency firm charges for its Bitcoin trading

is the second hint that you have to make sure to look into. A point

to note is the most suitable digital currency firms are costly.

This is always the case as such digital currency firms can assure

their clients of impeccable Cryptocurrency

trading. To hire such a digital currency firm, you should be ready

to spend more. However, spending too much need not be necessary as

it can be detrimental to your finances.

There is also importance in you ensuring that you check on the

traits that the Digital currency firm you want to hire has. Looking

at this aspect is important as it will let you understand the kind

of cryptocurrency trading you will be accorded by hiring the

Digital currency firm. Now, you have to look at the feedback of the

past clients. It is advisable for you to go for the highly rated

digital currency firm as with this, you can be sue of satisfactory

cryptocurrency trading. You can also depend on references to

identify a suitable digital currency firm that will give you

quality cryptocurrency trading.

Researching is hence an important step that you need to take. This

will guide you in discovering the background information of several

digital currency firms. The next thing will be for you to go for

professionals that will guarantee you of satisfactory

Cryptocurrency trading. To ensure that you do not encounter any

challenge through the search, there are factors that you will have

to look into. This site has given an explanation of the points for

choosing a suitable Digital currency firm and thus reading it

should be a priority to you.

The experience of the Digital currency firm in the industry is

something that you need to check out. Why you should put into

consideration this aspect is because there are also new entrants in

the industry. There is need for your to prioritize the digital

currency firm that has operated for a considerable number of years.

The experts can exist for so long only...

12:43

Allowing Coinbase to go public was not a blessing from regulators SEC Cointelegraph.com News

The SEC argued that just because it approves an S-1 filing from a company does not mean the firm is not operating or will not operate in violation of the law.

08:56

Its time for the SEC to settle with Coinbase and Ripple Cointelegraph.com News

The Securities and Exchange Commission should recognize its time to settle its cases against Coinbase and Ripple Labs.

08:10

Coinbase to Pause Staking in California, New Jersey, South Carolina and Wisconsin CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Coinbase app on smartphone (Chesnot/Getty Images)

08:07

Coinbase pauses staking services in four US states following regulators orders Cointelegraph.com News

According to the U.S. crypto exchange, only regulators actions in California, New Jersey, South Carolina and Wisconsin require a pause in staking additional assets.

07:00

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board NewsBTC

In a long-awaited decision, Judge Torres ruled in favor of XRP in their case against the U.S. Securities and Exchange Commission (SEC) yesterday. The verdict is a positive development for the cryptocurrency industry, particularly with a focus on whether digital assets should be deemed securities in the US.

The ruling is expected to set a precedent for the industry moving forward. It is positive for both altcoins and the wider industry, as the default expectation is that these assets are not deemed securities so long as they are made available to the public.

This event will likely have wider implications for ongoing legal cases and may help rebuild confidence in the industry for developers and attract more liquidity to the ecosystem.

XRP Defies Expectations With Massive Price Surge And Trading Volume Spike

Following the news, XRP saw a surge in price, reaching as high as $0.93, the highest price since May 2021, and closing at $0.82.

According to data compiled by the research company CCData, the news led to an influx of trading activity, with XRP trading pairs on centralized exchanges (CEX) recording a total volume of $6.05 billion on the day, an increase of 1351% from the previous day.

The relisting of the asset on other centralized exchanges, including Coinbase, Kraken, and Gemini has also contributed to the spike in volumes.

The news surrounding the ruling also led to almost 100% daily gains for XRP, with other tokens such as Solana (SOL) and Cardano (ADA), recently deemed securities, seeing significant gains of 35% and 28%, respectively.

Despite the negative backdrop that XRP has faced due to the lawsuit, its market depth liquidity at the 1% level has remained resilient year-to-date (YTD). XRPs 1% bid/ask side depth at Yearly Open was 26.5 million XRP, which saw a variance of 0.41% throughout the year and remained strong at 25.1 million XRP on the 12th of July.

Derivatives Data Shows Positive SentimentAccording to the report, Derivatives data indicate that XRPs positive funding rate remained steady over the past few days, in line with the wider positive market sentiment.

The lawsuit news generated a significant rise in speculative interest on the bid side, with a $280 million increase in Open Interest, from $635 million to a high of $913 million across exchanges. Moreover, funding rates reached over 0.03% across exchanges, over three times higher than its baseline level of under 0.01% before the announcement.

On the other hand, the funding rate history of XRP shows that speculators trading perpetual contracts have been favoring the upside, with minimal time...

06:43

06:30

Token hoarders defeat the purpose of most DAOs: Study Cointelegraph.com News

The study also showed that decentralized organizations work best when theyre built around a tight-knit group of focused participants.

06:29

Cardano price turns bullish, but is there substance to the ADA rally? Cointelegraph.com News

Cardanos DeFi footprint and network activity show an uptick in users, but will it be enough to sustain ADAs recent bullish price action?

06:20

Ethereum scaling protocols drive zero-knowledge proof use: Finance Redefined Cointelegraph.com News

The top 100 DeFi tokens had a mixed week, with most of the tokens trading in a narrow range before surging on July 13 courtesy of Ripples partial win in its court battle with the SEC.

06:06

DeFi Lender MarginFi Fuels Growth With Loyalty Points, Spurring Talk of Solana Renaissance CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

MarginFi banner. (Danny Nelson/CoinDesk)

06:01

Hip-Hop Collab Teams PUMA, Roc Nation and Legitimate for Sneaker Release CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

"Evolution of the Mixtape" Sneaker (Legitimate)

06:00

BlockFi CEO ignored risks from FTX and Alameda exposure, contributing to collapse: Court filing Cointelegraph.com News

Crypto lending firm BlockFi had roughly $1.2 billion in assets tied to FTX and Alameda Research when the firm filed for bankruptcy in November 2022.

05:59

XRP Gets Binance.US Listing as Exchange Joins Rivals Embrace CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Binance.US opened for XRP trading. (mcmurryjulie/Pixabay)

05:54

05:54

05:53

What Ripples Partial XRP Win Means for Other Crypto Firms Fighting SEC CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

A court ruling that some XRP sales were not investment contracts, may give other defendants in SEC cases a new arrow in their quiver. (Marija Zaric /Unsplash)

05:50

Could the Ripple Ruling Spell the End of Regulation by Enforcement? CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

SEC Chair Gary Gensler at a U.S. Treasury council hearing in October 2022 (Anna Moneymaker/Getty Images)

05:28

05:10

Ripple's Legal Win Means It's Time for Crypto to Stand Up to the SEC CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(Nayani Teixeira/Unsplash, modified by CoinDesk)

05:00

Large Exchanges Relist XRP Following Ripple Victory Over SEC NewsBTC

In a significant turn of events, large cryptocurrency exchanges Coinbase, Kraken, Bitstamp, and Gemini announced their decision to relist XRP after a significant legal victory for Ripple against the Securities and Exchange Commission (SEC).

This momentous decision comes as a result of the exchanges reevaluating their previous delisting of XRP, showcasing a renewed confidence in the tokens regulatory standing. This was brought about by the recent landmark court ruling by Judge Analisa Torres.

Coinbase, Kraken, And Bitstamp Reinstate XRP Trading

Coinbase, a leading cryptocurrency exchange, wasted no time in announcing the resumption of XRP trading following the court ruling. Brian Armstrong, the CEO of Coinbase, expressed the exchanges decision in a tweet, stating:

Coinbase will re-enable trading for XRP (XRP) on the XRP network. Do not send this asset over other networks or your funds may be lost. Transfers for this asset remain available on @Coinbase & @CoinbaseExch.

The reinstatement of the digital asset on Coinbases platform marks a significant shift in their position after delisting the token in January 2021. Kraken, another prominent exchange, also confirmed its plans to reinstate trading for the cryptocurrency, as Marco Santori, Kraken Legal Officer tweeted stated:

1/ This morning, the Federal Court for the Southern District of New York ruled that XRP is not a security. As such, just a few minutes ago, Kraken re-enabled trading in XRP for US users.

Bitstamp, an early adopter of XRP, joined the bandwagon, emphasizing its role as a leading liquidity venue for the asset globally as it confirms the return of the token on its exchange for US users.

Ripples Legal Battle And Market Impact

The court ruling stems from the SECs lawsuit against Ripple, which accused the company of conducting an unregistered securities offering through the sale and distribution of XRP.

Ripple chose to fight the lawsuit, investing substantial resources into the legal proceedings. The outcome of this case carries significant weight for the cryptocurrency industry, as it determines the regulatory oversight faced by digital asset firms.

Although Judge Torres recent summary judgment concluded that while Ripples initial sale of XRP to institutional investors could be classified as a securities offering, the subsequent trading of the tokens on crypto excha...

05:00

Filecoin storage utilization surpasses 7% in Q2: Report Cointelegraph.com News

Although utilization rose, protocol and supply revenue declined, as more providers slashed fees to incentivize adoption.

04:58

Crypto Distress Prompts Fir Tree, a Hedge Fund, to Seek Profit From Turmoil CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(Art Institute of Chicago/Unsplash)

04:46

Is the Metaverse a 'Global Panopticon'? CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(Milan Malkomes/Unsplash, modified by CoinDesk)

04:32

04:31

Ripples XRP Ruling a Milestone Win for Crypto Industry, Says J.P. Morgan CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

A summary judgment partially in favor of payments network Ripple represents a milestone win for the crypto industry and provides legal clarity as to what does and doesnt represent a security, J.P. Morgan wrote in a research note Friday.

04:10

Crypto lender Geist Finance shuts down permanently over Multichain hack Cointelegraph.com News

The $29 million TVL lending platform is shutting down because its oracles are misreporting Multichain token values after the exploit.

04:03

Auction House of Gucci: Christies Teams Up With Luxury Brand on NFT Collection CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Artwork by Emily Xie (Christie's)

04:02

Ex-Celsius CEO Alex Mashinsky's Bail Set at $40M, Travel Restricted CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Alex Mashinsky Founder and CEO Celsius Network at Consensus 2019 (CoinDesk)

04:02

Price analysis 7/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, LTC, MATIC, DOT Cointelegraph.com News

Bitcoin and several altcoins are taking a breather after the sharp rally of the past two days, but the general trend remains bullish.

04:01

Binance headcount reduction hits 1,000 employees: Report Cointelegraph.com News

The ongoing workforce reduction is reportedly global, with customer service workers heavily affected.

04:01

Ripple Labs Ruling Throws U.S. Crypto-Token Regulation into Disarray CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Ripple CEO Brad Garlinghouse (Getty Images)

04:01

XRP Overtakes BNB to Become 4th Largest Cryptocurrency; Funding Rates Surge CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Top cryptocurrencies by market value (CoinDesk Indices)

04:00

PEPE Sees Sharp 17% Surge, But Will This Whale Spoil The Party? NewsBTC

On-chain data shows a PEPE whale has made a large deposit to Binance, something that could provide an impedance to the meme coins rally.

PEPE Whale Has Deposited $7.2 Million To Binance

According to data from the cryptocurrency transaction tracker service Whale Alert, a massive PEPE transfer has occurred on the Ethereum blockchain during the past day.

The transaction in question involved the movement of 3.94 trillion PEPE, which was worth almost $7.2 million at the time the transfer went through on the network.

Generally, only the whale entities are capable of making such large moves, so its reasonable to assume that a whale investor would have been behind this transfer.

Due to the massive amount of capital involved in transactions of these humongous investors, they can sometimes cause noticeable fluctuations in the price of the asset.

As such, the movements of the whales can be something to watch out for. How such transfers may affect the market, though, depends on the exact intent the investor had behind it.

Here are some additional details regarding the relevant PEPE whale transfer, which may shed some light on what the whale wanted to achieve with the move:

As you can see above, the sending address in the case of this PEPE transfer is an unknown wallet, meaning that its an address unattached to any known centralized platform, making it likely that its the personal wallet of an investor.

The receiving address, on the other hand, looks to be a wallet affiliated with a centralized platform. More specifically, this address is connected to the cryptocurrency exchange Binance.

Transfers like these, where coins move from self-custodial wallets to exchanges are called ...

03:59

XRP Short Traders Log Highest Losses in 2023 After Landmark Court Ruling CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

XRP and DOGE took off while other cryptos flatlined. (SpaceX/Unsplash)

03:02

Hollywoods Angry Creators Show Why Web3 Is Needed CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Members of the Writers Guild of America East and SAG-AFTRA in New York City (Alexi Rosenfeld/Getty Images)

03:00

Everything thats happened with Celsius and Alex Mashinsky so far Cointelegraph.com News

A look back at the rise and fall of Celsius, from the firms growth during the pandemic to the arrest of its former CEO and resolutions with federal regulators.

02:30

Crypto will transcend international currencies BlackRock CEO Cointelegraph.com News

Larry Fink states that global investors are increasingly eager to add crypto assets to their portfolios.

02:28

02:28

Solana price hits a 2023 high, but do strong fundamentals back the SOL rally? Cointelegraph.com News

SOLs price rallied to a year-to-date high above $30, but Solanas struggle with increasing its user stats calls the current bullish momentum into question.

02:05

Google Plays Nice With NFTs, Starbucks Puts Ex-MLB Stars NFT Project on Deck CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Google play on a laptop (Getty Images)

02:01

3AC co-founders OPNX exchange onboards FTX, Celsius bankruptcy claims Cointelegraph.com News

Claims can be converted into collateral to trade crypto futures on the exchange.

02:00

Heres What On-Chain Data Reveals About XRP Rally NewsBTC

XRP has observed a massive 67% rally during the past 24 hours. Here are some facts on-chain data reveals about this price surge.

Several Indicators Have Surged Following The XRP Rally

In its latest insight post, the on-chain analytics firm Santiment has looked into the underlying metrics related to XRP as the cryptocurrency has seen an extremely sharp surge during the last day.

This rapid growth in the assets value has come following Ripples victory in court as XRP has been declared not a security. Immediately after the announcement, the coin had managed to rise by around 90%, but in the hours since then, the asset has taken some hit.

Nonetheless, the cryptocurrency has still managed to hold onto the majority of its gains so far, as its still up 67%. This rise has now made the asset the fourth largest in the space in terms of market cap, as it has leapfrogged past BNB.

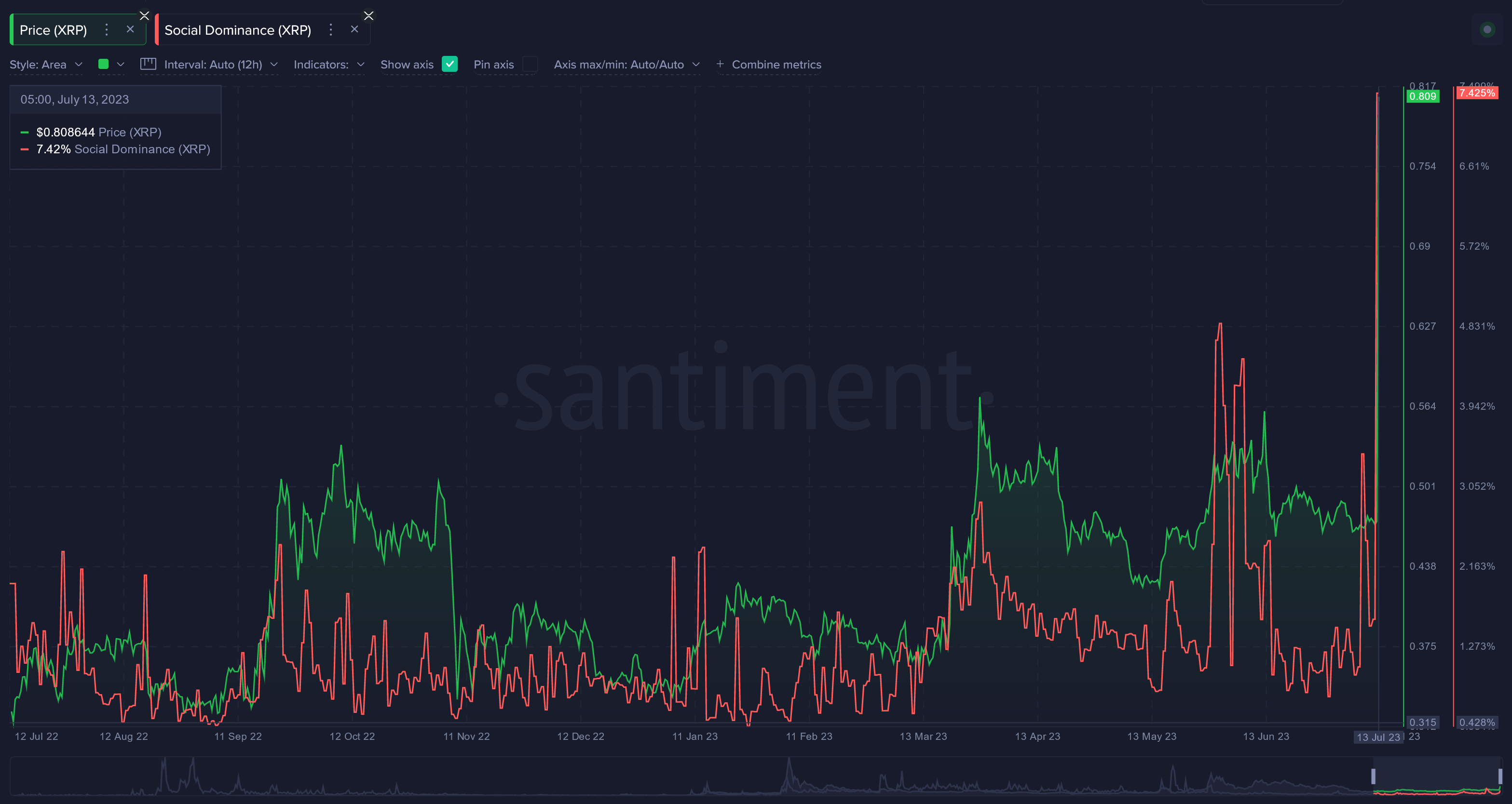

Following the rally, the social dominance of XRP saw a sharp surge toward the 7.4% mark, as the below chart displays.

Social dominance measures how the discussions on social media related to any given coin (which, in this case, is XRP) compare against the combined amount of talk the top 100 assets by market cap are receiving currently.

At the current value of the metric, 7.4% of all discussions related to these top 100 coins are coming from XRP alone. Such a high amount of interest among social media users is generally a sign of euphoria, which usually leads to a correction in the price. This may explain why the asset has taken a hit since the initial jump.

In terms of whale activity, the network has naturally been active during this surge, as these humongous investors have made a large number of transactions, as shown below.

...

01:59

Mutinys New Browser-Based Bitcoin Wallet on Lightning Avoids App Store Restrictions CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Mutiny wallet team. (Twitter user @SpecificMills)

01:38

Transparency for the Whales, Privacy for the Plebs CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

NOWHERE TO HIDE? Eventually, everyones blockchain identity will be linked to their real-world identity, Arkham Intelligence predicts. (Library of Congress/Interim Archives/Getty Images)

01:38

Friday assorted links "IndyWatch Feed Economics"

1. Bhutan has been mining bitcoin.

2. Dwarkesh interviews Andy Matuschak on how to learn (and other things).

3. AI measures the value of different chess squares.

4. Soil quality and state capacity?

5. Goldman-Sachs report on the economics of generative AI.

6. Filipino-Americans outearn both Japanese-Americans and white Americans.

The post Friday assorted links appeared first on Marginal REVOLUTION.

01:21

BlackRock CEO Larry Fink Talks Up Crypto Demand From Gold Investors CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

BlackRock CEO Larry Fink (Getty Images)

01:00

XRP Kicks Out BNB To Become 4th-Largest Crypto After 65% Rally NewsBTC

XRP, the token behind the Ripple payment network, has been on an absolute monster rally in the last day. The token has seen a 65% price surge that propelled it into the number 4 spot in the crypto rankings, pushing BNB down to 5th place, even though BNB on the other hand, is also up by 9% in the past week.

XRP Overtakes BNB

XRP recently overtook BNB after reaching a yearly high of $0.81, giving the cryptocurrency a market cap of $41 billion. The huge price spike can be attributed to investors jumping on the bandwagon with fear of missing out on XRP after the big news regarding its victory over the United States Securities and Exchange Commission (SEC).

The court determined on June 13 that the sale of XRP to regular investors does not constitute the sale of an unregistered security. As such, United States District Judge Analisa Torres ruled in partial favor of Ripple, saying that XRP sales on public cryptocurrency exchanges were not offers of securities under the law.

However, the judge remarked that Ripples direct sale of XRP to institutional investors in the amount of approximately $700 million violated federal legislation regarding the sale of securities.

This catapulted XRPs price from $0.478 to $0.7885 in just under a day. With its current market cap, this means XRP is now the third-largest native cryptocurrency behind Bitcoin and Ethereum when the USDT stablecoin is removed.

24-Hour Trading Volume Spikes 1700%+

According to data from Coinmarketcap, XRPs 24-hour trading volume has spiked a whopping 1,758.13% to over $13.49 billion. Trading volumes have surged on various exchanges, where Upbit, the South Korean-based crypto exchange, had over $2.7 billion in 24-hour trading volume. Binance also saw over $2.3 billion in trading volume as investors scurried to buy XRP.

Coinglass data shows more than $35 million short position trades on XRP have been liquidated in the past 24 hours. Most of these are from Bybit, OKX, and Binance, with $21 million, $14 million, and $14 million in short position liquidations, respectively.

Of course, fast price rises often end in pullbacks as XRP remains a volatile digital asset. But its recent breakout shows its still an altcoin to watch, with the potential for even bigger gains if more investors continue to FOMO. However, XRPs potential for long-term growth continues to be supported by Ripple Labs real-world value as a payments network.

At the time of writing, XRP is stil...

00:55

First Mover Asia: Bitcoin Soars to One-Year High at $31.7K as Crypto Investors Savor Partial Ripple Victory CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Bitcoin daily price chart. (CoinDesk Indices)

00:54

XRP Ruling a Landmark Judgment, Weakens SEC's Stance Against Crypto: Bernstein CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

The U.S. court's ruling on XRP is a blow to the SEC's stance of crypto being considered a security, Bernstein says. (the_burtons/Getty)

00:54

XRP Trading Volumes Hit $2.5B on South Korean Exchange UpBit CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

South Korea flag (Daniel Bernard/ Unsplash)

00:54

Bitcoin's Crypto Market Dominance Slides by Most in 13 Months as XRP Court Ruling Spurs 'Alt Season' Talk CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Bitcoin's dominance rate. (TradingView)

00:53

First Mover Americas: XRP Gains 66% on Ripples Partial Court Victory CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

The latest price moves in bitcoin (BTC) and crypto markets in context for July 14, 2023. First Mover is CoinDesks daily newsletter that contextualizes the latest actions in the crypto markets.

00:53

00:52

Ripples XRP Token Surges 96% After Partial Victory in SEC Lawsuit CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

XRP climbed as high as 64 cents at one point, its highest level since May.

00:52

Why is Cardano price up today? Cointelegraph.com News

Cardano price has rallied substantially as traders see its potential of bypassing the SEC's regulatory threats based on the recent Ripple win.

00:51

Ripple, Crypto Industry Score Partial Win in SEC Court Fight Over XRP CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Ripple CEO Brad Garlinghouse (Danny Nelson/CoinDesk)

00:51

Coinbase, Other Crypto Exchanges Embrace XRP After Court Ruling CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Ripple CEO Brad Garlinghouse (Getty Images)

00:23

Bitcoin spending copies history as metric flags 1st stage bull market Cointelegraph.com News

Bitcoin on-chain spending is heating up and, so far, is rhyming with past BTC price cycles.

00:00

Crypto Liquidations Cross $300 Million Amid Massive Market Recovery NewsBTC

The last 24 hours have been more than interesting for crypto investors across the globe. Thursday, July 13, saw one of the most important lawsuits in the history of the industry come to an end, and the ruling in favor of Ripple triggered a massive rally. As digital assets across the space recorded double-digit gains, liquidation volumes climbed quickly, now clocking over $300 million.

Crypto Short Traders Take Big Losses

The high volumes of crypto liquidations in the market so far have been a result of price recovery. As such, the vast majority of traders who have been losing money have been short traders, that is, traders who were betting on prices falling rather than recovering.

According to data from Coinglass, out of the over $300 million in liquidations, short traders made up for a total of $219 million. On the flip side, the volume from long traders was much lower, coming in at only $82.74 million for the same 24-hour period. This means that short traders made up 70.33% of all liquidations during this time, as long traders made the most money.

Furthermore, over 86,000 traders saw their positions liquidated on the last day, but the single largest liquidation happened on the Bitmex exchange. This position was worth $2.82 million at the time of liquidation, taking place across the XRPUSD pair on the exchange.

As expected, Bitcoin led the liquidation volumes during this time, but interestingly, Ethereum was not the second-highest volume as it usually is. That title was claimed by XRP traders this time around with a total of $62.17 million liquidated in 24 hours.

Will The Liquidations Continue?

A major factor behind...

00:00

Binance CEO reflects as exchange turns 6 It was never all smooth sailing Cointelegraph.com News

Binance CEO Changpeng Zhao wrote that decentralized finance will continue to accelerate, and more people will interact with DeFi products.

Friday, 14 July

23:35

23:34

Ripples XRP Summary Judgment Positive for Coinbase, Price Target Raised to $120: Needham CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Coinbase logo on a laptop computer (Piggybank/Unsplash)

23:10

United Kingdoms digital pound meets public backlash Why? Cointelegraph.com News

The use of physical currency for transactions is plummeting globally, so why is the U.K. so tentative with its own central bank digital currency?

23:03

Coinbase CEO Brian Armstrong Asks Twitter Followers if Their BofA Accounts Were Closed Because of Crypto Transactions CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Coinbase CEO Brian Armstrong (CoinDesk archives)

23:00

Polygon Reclaims 10th Position As MATIC Surges Nearly 30% In One Week NewsBTC

The crypto market continues to exhibit dynamic shifts as Polygons native token, MATIC, outpaces Litecoin (LTC) in the global rankings to secure the 10th spot. This move comes after MATIC experienced a surge of nearly 30% over the past week.

Resurgence Amid Crypto Rally

The general upswing in the crypto market in the past week has presented opportunities for numerous cryptocurrencies to make significant strides. Polygon (MATIC), for one, has capitalized on this trend, breaking through multiple resistance levels to claim the 10th position in the global crypto market, thereby leaving Litecoin (LTC) trailing behind.

The assets surge, which saw MATIC price climbing from a low of $0.67 last Friday to a high of $0.88 yesterday before retracting to $0.84 at the time of writing, marks a nearly 30% increase in the past 7 days.

The surge also signals MATICs resilience, given that it comes just a month after the United States Securities and Exchange Commission (SEC) classified it as a security, triggering a drastic dip in its value. This move by the SEC made MATIC dwell in a bloodbath for a week to trade below the $0.6 mark.

MATIC Road To Recovery

MATICs recovery, however, has been somewhat fascinating. Over the past 24 hours, MATIC has rallied by nearly 10%, exhibiting a strong upward trajectory. Interestingly, this rally mirrors the movements of several notable altcoins in the market, indicating a wider market recovery trend.

Despite the initial setback following the SECs classification, MATIC has demonstrated a comeback. Its rebound not only highlights the resilience of the asset but also underscores its growing popularity among investors, which can be attributed to the increasing interest in the Polygon platform, known for its scalability solutions for Ethereum transactions.

MATIC has witnessed a dramatic rise in its market capitalization over the past week, marking a nearly $2 billion increase. The digital asset, starting from a valuation of $6.2 billion last F...

22:53

Why Did Celsius Go Up in Flames? Alex Mashinsky Built Celsius a House of Cards CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Consensus 2019 Alex Mashinsky Founder and CEO Celsius Network (CoinDesk)

22:40

A Simple Plan: "IndyWatch Feed World"

Barry Silbert, the founder as well as CEO of Digital Money Group,

has actually been a popular number in the cryptocurrency industry

for several years. Read more about Barry Silbert on this website.

As a very early supporter for Bitcoin (BTC), Silbert has been

actively associated with promoting positive changes for the globes

largest cryptocurrency. His initiatives have not just helped raise

understanding regarding BTC but have also added to its mainstream

fostering. Learn more about Cryptocurrency on this homepage.

Among the key initiatives that Silbert has promoted is the facility of the Grayscale Bitcoin Count On (GBTC). View more about Digital Currency Group on this page. This investment car enables institutional and private financiers to obtain direct exposure to Bitcoin without needing to directly buy and also keep the cryptocurrency themselves. Check Barry Silbert Millionaire here for more info. The GBTC has played a substantial function in bringing Bitcoin to conventional financial markets, making it extra accessible to a larger range of financiers. Discover more about Gensis Trading on this link.

In addition to the GBTC, Silbert has actually additionally contributed in sustaining Bitcoin-focused startups via Digital Money Group (DCG). Check out Grayscale on this site. DCG is an equity capital firm that has invested in numerous companies in the cryptocurrency room, including Coinbase, Surge, as well as Chain. Read Foundry here for more info. By offering financing and also assistance to these startups, Silbert has actually helped foster innovation as well as development within the Bitcoin ecological community. Click Crypto here for more updates.

Additionally, Silbert has actually been proactively involved in advocating for regulative clearness for cryptocurrencies. View Bankruptcy here for more details. He has been a singing advocate of collaborating with regulatory authorities to develop practical. View Gensis Trading here for more details. and balanced frameworks that motivate advancement while securing financiers. Click Bitcoin for more info. Silbert believes that clear as well as clear laws are vital for the long-term development and stability of the cryptocurrency industry. Read more about BTC on this website.

On The Whole, Barry Silberts contributions. Learn more about Barry Silbert Millionaire on this homepage. and...

22:33

How the Celsius Affair Plays Into the U.S. Crypto Regulatory Debate CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Celsius Thermometer (Unsplash/Modified by CoinDesk)

22:07

7 blockchain-based platforms for content creators Cointelegraph.com News

From Steemit and LBRY to Ujo Music and SuperRare, discover how blockchain technology empowers content creators in the digital age.

22:00

Shiba Inu (SHIB) Shows Strength With 5% Rally, Reversal Confirmed? NewsBTC

The Shiba Inu price has risen over 5% in the last 24 hours amid the market-wide hype surrounding Ripples partial victory in its legal battle with the US Securities and Exchange Commission (SEC). But SHIB investors should still be cautious: While the SHIB price shows a clear uptrend of 23% over the last 30 days, a complete confirmation of a trend reversal is still pending.

Shiba Inu Price Analysis

Technically, the Shiba Inu price remains in bearish territory for several reasons. As explained in previous analyses, the Shib price entered a downtrend channel in early February this year. The breakout from the bearish chart pattern succeeded six days ago, however, there is still a possibility that it is a fakeout.

Shibs trading volume was rather below average during and after the breakout. Only yesterday there was a noticeable increase. Within the last few hours, trading volume rose to $232 million, 200% higher than the previous day. In the best case, the volume should remain high to avoid a fakeout.

More of a bearish argument is that yesterdays SHIB rally stopped at $0.00000813. Thus, the price could not break above resistance at $0.00000816, nor could it set a new local high on the 4-hour chart.

A look at the 1-day chart also shows that the SHIB price continues to trade below the 23.6% Fibonacci retracement level at $0.00000832. The following days could become crucial to confirm a sustainable trend change or a fakeout.

The battle between bulls and bears is still in full swing. The bull side would ideally like to break out above the 23.6% Fibonacci retracement level with a high trading volume. This could be a first confirmation for a sustainable trend change.

In this case, the 38.2% Fibonacci retracement level at $0.00000977 could come into focus. Close to it is also the long-term bull boundary line, the 200-day exponential moving average (EMA) at $0.00000961. If SHIB also exceeds this level, one can finally speak of a trend reversal. Before that, however, the current gains stand on shaky legs.

...22:00

FTX, Celsius Bankruptcy Claims Can Now Be Sold on OPNX CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

Kyle Davies, Su Zhu, Mark Lamb (Kyle Davies/Twitter)

22:00

Protection Against The Financial System Requires More Than A Spot Bitcoin ETF Bitcoin Magazine - Bitcoin News, Articles and Expert Insights

This is an opinion editorial by David Waugh, a business development and communications specialist at bitcoin investing platform Coinbits.

A few weeks ago, BlackRock and other major financial firms filed for permission to offer spot bitcoin exchange-traded funds (ETFs).

Though the U.S. Securities And Exchange Commission(SEC) stated that these initial filings were inadequate, forcing the firms to refile, many investors believe that they will eventually be approved, creating the first-such products on the market. These new financial instruments would allow institutional and retail investors to access exposure to bitcoin's price without having to purchase actual bitcoin.

On the surface, this would be a major win for Bitcoin adoption because it will become easier for financial advisors, previously hesitant or unable to enter this market, to assist clients with a form of bitcoin allocation.

Banks and other traditional financial players will also use the spot ETF to increase their exposures, which may increase bitcoin's exchange rate with the dollar. For families and individuals, however, shares of a bitcoin product through spot ETFs are not a substitute for holding bitcoin in self custody.

Ultimately, Bitcoin ETF products still exist within the traditional financial system and do not offer complete protection from market, government or compliance risk. As such, market forces can affect the ETF issuers, and governments can enact and enforce regulations by decree that devalue or debase the consumer's assets.

In contrast, holding real bitcoin allows individuals to access a digital bearer asset outside of control of governments and traditional financial institutions. Though it introduces new risks associated with private key management, every diversified portfolio should have a real bitcoin allocation, regardless of any additional allocation to a bitcoin ETF.

As investors seek to diversify to spread risk and protect themselves from geopolitical and market shocks, there is no substitute for bitcoin in self custody.

Advice Outside Of The Financial System

For years, financial advisors have dutifully a...

21:35

Stablecoin TrueUSD Owner Techteryx to Take Full Control of Operation CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

US banknote image via Shutterstock

21:30

The Death of a Discord Server CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

(ELLA DON/Unsplash)

21:12

Indonesia to launch crypto exchange in July: Report Cointelegraph.com News

Once launched, Indonesias national crypto exchange will be the only platform allowing crypto transactions, the local regulator said.

21:01

XRP tops Bitcoin on Upbit with $2.6B of trading volume in 24 hours Cointelegraph.com News

Following a partial win in its long-running court battle with the SEC, Ripples XRP token surged over 90% on July 13, reaching a new yearly high of $0.91.

21:00

Stellar (XLM) Basks In XRP Euphoria, Soars 52% In One Day NewsBTC

The price of Stellar (XLM) has experienced a similar meteoric rise to the XRP token in the last 24 hours. This rise was triggered by news that Ripple, the company behind XRP, had won its long-running case against the US Securities and Exchange Commission SEC.

The SECs case that XRP is a security was the focus of the court trial. To the delight of the crypto community, Judge Annalisa Torres of the US District Court for the Southern District of New York ruled in Ripples favor, declaring the XRP token not to be a security.

Stellar Looks To Enter The Top 20 Crypto Ranking

The altcoin market had been dominated by bearish pressure in recent weeks due partly to the SECs declaration of tokens tied to Solana, Polygon, and Cardano as securities. This declaration formed the foundation of the regulators case against prominent crypto exchanges Coinbase and Binance.

Related Reading: Optimism (OP) Rides The Wave Of Todays Crypto Surge With 15% Rally

That said, the market was jolted back to life yesterday following the announcement of Ripples court victory, with most tokens basking in green. Stellar also reacted swiftly to positive market sentiment, going on an almost 90% price rally within a few hours.

The tokens price has since steadied, with Stellar currently trading with a 52.4 % gain. With this, XLMs price rise places it amongst the top daily gainers in the cryptocurrency market today.

As of this writing, XLM is valued at $0.147189, with a 3.9% price decrease in the past hour. The token has a 24-hour trading volume of over $1.26 billion, representing a 3,386% surge in the past day.

According to CoinGecko data, the Stellar token is closing in on a spot in the top 20 largest cryptocurrencies, with a market cap of nearly $4 billion.

Is $0.8 Within Reach For XLM?

A look at the broader market shows that XLM has been underwhelming in recent days. Although the token scored some significant gains last month, it appears to have also been affected by the dour market conditions in July.

Following the positive price movement of yesterday, investors are hoping to see the XLM price visit the $0.8 again. However, after hitting its all-time high of $0.875563 in 2018, the coin has only ever reached the $0.8 level once.

Related Reading: XRP Price Retreats After Massive 80% Rally, Buy The Dips?

On the weekly chart, the XLM token must overcome resistance at $0.2 and $ 0.4 price levels. So, it...

20:01

Can XRP price hit $1? Watch these levels next Cointelegraph.com News

XRP price almost doubled after Ripples legal win against the U.S. SEC. But can its rally continue after nearly reaching $1?

20:00

Cardano Bulls Reclaim Control As ADA Rallies 28% NewsBTC

Following Ripple (XRP)s victory in court yesterday, there is a general bullish wave currently sweeping across the crypto market. According to data from CoinMarketCap, Cardano (ADA) has gained by 28.43% in the last 24 hours, with several other altcoins also posting double digits gains.

Cardano (ADA) Price Action And Analysis

Prior to its price boost yesterday, ADA had shown little to no movement all week, hovering around the $0.29 price mark. However, the tokens price spiked yesterday afternoon, reaching as high as $0.37 for the first time since early June.

Related Reading: XRP Price Retreats After Massive 80% Rally, Buy The Dips?

Looking at its broader performance, Cardano has had a mixed-price action since the start of 2023. The altcoin began the year in style, gaining over 70% to trade at $0.41 as of February 16.

This price surge was, however, followed by a bearish trend bringing the tokens price as low as $0.30 on March 10. Thereafter, ADA would resume its bullish trajectory, rising to its highest price so far in 2023 at $0.45 on April 16.

Over the next two months, Cardanos price slumped once again before showing sideways movement over the last three weeks.

Analyzing its 4-Hour Chart, ADA has encountered resistance at the $0.38 price zone and appears to be experiencing a recorrection. However, a rise in selling pressure could result in the token trading as low as $0.28, which marks its imminent support level.

On the other hand, if the bulls retake control and manage to push past the $0.38 resistance price level, ADA is likely to rise to $0.42, which represents the next major resistance level.

At the time of writing, ADA is trading at $0.35 with a 2.30% loss in the last hour. The tokens trading volume is up by a stunning 808.08% and is valued at $1.4 billion. With a market cap of $12.3 billion, Cardano is ranked as the 7th biggest cryptocurrency in the world.

Ripples Victory Sparks Altcoin Rally

Yesterday afternoon, U.S. Judge Analisa Torres ruled that XRP is not a security in the ongoing Ripple vs. SEC case. On the emergence of this news, the crypto market experienced a price boost, with mainly altcoins notching significant gains.

Asides from Cardano (ADA), coins such as Solana (SOL), Avalanche (AVAX), and Polygon (MATIC), are also on the rise, recording profits at 31.98%, 14.50%, and 17.76%, respectively, in the last 24 hours.

Related Reading: Optimism (OP) Rides The Wave Of Todays Crypto Su...

19:56

Multichain stops operations over lack of funds Cointelegraph.com News

The Multichain team said funds and access to servers are currently with their CEO, Zhaojun, who is under the custody of Chinese police.

19:27

AI proposal sparks conflict in Hollywood as SAG-AFTRA goes on strike Cointelegraph.com News

The AI proposal suggested that background performers should undergo scanning, receive payment for a single day, and grant companies complete ownership over the scan, image and likeness.

19:18

Bitcoin bulls have work to do after XRP price spikes 104% Cointelegraph.com News

Bitcoin may have tagged new yearly highs, but BTC price performance still needs to prove itself with a range breakout, traders argue.

19:00

MultiversX launches on-chain two-factor authentication standard Cointelegraph.com News

Blockchain protocol MultiversX has implemented a novel two-factor authentication mechanism to add additional security to its network.

18:49

Optimism (OP) Rides The Wave Of Todays Crypto Surge With 15% Rally NewsBTC

Optimism (OP), alongside major cryptocurrencies, has witnessed a remarkable surge in value amidst a wave of positive momentum sweeping through the broader crypto market.

The recent victory of Ripple against the US Securities and Exchange Commission has sparked a sea of green, with investors expressing renewed confidence in the industry.

In this flourishing environment, Optimism Networks OP coin stands tall, exhibiting an impressive surge of nearly 15% in the past seven days.

But can the Optimism Network sustain its upward trajectory in the face of regulatory challenges?

OP Bulls Target $1.3 Resistance Level

In the ever-changing landscape of the cryptocurrency market, the current price of OP coin on CoinGecko hits $1.38, reflecting a noteworthy rally of 14.2% over the past 24 hours. Additionally, within the last seven days, the coin has experienced an impressive surge of 14.7%.

Since the first week of July, OP has been trading below the $1.3 mark. However, an OP price report notes that bullish investors are eyeing this crucial threshold to flip the H2 structure (see chart below) into a bullish trend.

The $1.3 resistance level has posed a challenge for the OP coins value, preventing it from surpassing this critical point. Bulls in the market are striving to overcome this hurdle, which would signal a potentially bullish trend for the coin.

Breaking through a resistance level...

18:47

Celsius pleased with resolutions amid $4.7B FTC fine Cointelegraph.com News

A community member responded that they were also pleased to see former Celsius CEO Alex Mashinsky charged with multiple crimes.

18:22

How to use index funds and ETFs for passive crypto income Cointelegraph.com News

Index funds and ETFs offer attractive options for passive income investing, providing investors with diversified exposure to various crypto assets.

18:16

US Representative Torres demands investigation of SEC deal with Prometheum Cointelegraph.com News

The United States Securities and Exchange Commission might be investigated for a haphazard and heavy-handed approach to digital assets.

18:12

Googles Bard overcomes EU hurdles, expands territories and capabilities Cointelegraph.com News

The new features include hearing spoken responses, uploading images for prompts and utilizing the AI tool to analyze photos.

17:55

Why Is Bitcoin Price Up Today? NewsBTC

The Bitcoin price tagged a new yearly high yesterday at $31,840, leaving market participants wondering about the driving forces behind this bullish momentum.

The Power of Economic Indicators

One of the crucial factors contributing to Bitcoins upward trajectory was the release of the United States Producer Price Index (PPI) data. The latest figures revealed a significant slowdown in inflation, with PPI YoY dropping to 0.1% in June, surpassing expectations and marking the smallest pace since August 2020. Notably, the Core PPI YoY came in at 2.4%, slightly below the estimated 2.6%, reinforcing the notion of a diminishing inflationary environment.

This decrease in PPI is seen as a positive sign for the Consumer Price Index (CPI), providing hope for a more stable economic landscape. Macro researcher Mortensen Bach emphasized the significance of the PPIs impact, stating, PPI always leads CPI. Inflation is no longer a thing and input prices clearly indicate that! Deflation remains the primary risk going forward. This is what happens when you have a Federal Reserve who is blindly focused on backward-looking data!

Echoing these sentiments, macro analyst Ted added, PPI inflation leads CPI by a few months and todays PPI numbers have YoY running at +0.24%. Almost in deflation! Fed pivot anyone?

Also worth noting is that, May PPI inflation was revised lower from 1.1% to 0.9%. May Core PPI inflation was revised lower from 2.8% to 2.6%. The drop and revision lower in Core PPI is what the US Federal Reserve wants to see.

Inverse Correlation With The DXY

Another pivotal factor driving Bitcoins surge is the recent drop in the US Dollar Index (DXY) below 100.00, a level not seen in 15 months. This development has sparked renewed interest in risk assets like Bitcoin as a hedge against a weaken...

17:44

17:16

Ripple CTO warns against XRP scams amid SEC-induced hype Cointelegraph.com News

The XRP price rallied over 70% bringing up its value from $0.47 to $0.82 in a day. The incident also marks the biggest price jump for XRP in the past year.

16:31

Congressman Torres Calls for Investigation Into SEC Over its Approach to Crypto CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data

The U.S. Capitol in Washington DC (Jesse Hamilton/CoinDesk)

15:59

Monochrome Bitcoin ETF gets filed to Australian securities exchange Cointelegraph.com News

The CEO believes investors will be inclined to seek exposure to Bitcoin in a more familiar, structured and protected regulatory environment.

15:52

Sam Altmans Worldcoin passes 2M sign-ups after months of touring Cointelegraph.com News

Worldcoin surpassed two million sign-ups to World ID in less than half the time it took to reach one million.

15:38

Why is Polygon (MATIC) price up today? Cointelegraph.com News

MATIC price surged due to favorable regulation, increased network use and anticipated Polygon 2.0 upgrade that could see a rebrand to POL.

15:29

Sam Bankman-Fried wants close friends to visit without a security pat down Cointelegraph.com News

Under bail conditions, only Sam Bankman-Frieds lawyers are exempt from security checks, now theyve asked if this can be extended to close friends.

14:18

XRP Price Retreats After Massive 80% Rally, Buy The Dips? NewsBTC

XRP price rallied over 80% after the courts ruling and jumped above $0.80 against the US Dollar. It tested the $0.95 zone and is currently correcting gains.

- Ripples token price surged above the $0.65 and $0.80 resistance levels against the US dollar.

- It is trading well above $0.5000 and the 100-day simple moving average.

- There was a break above a major bearish trend line with resistance near $0.50 on the daily chart of the XRP/USD pair (data source from Kraken).